|

No list of links in this update. Just start reading....

Premium Snippets

Before I forget, we do provide a few insights on the gold stocks and Silver in this video market update. FYI, the sound of the video is not consistent and we did record ourselves testing the volume.

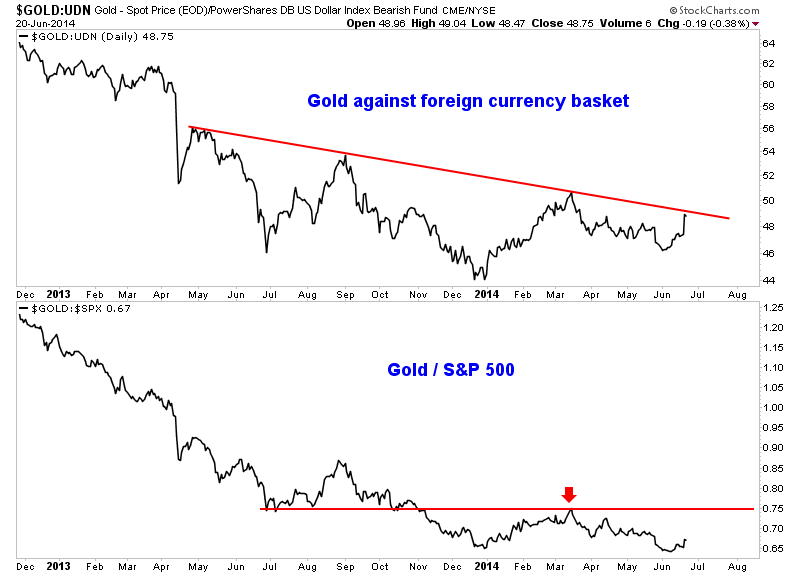

Moving along, here is one chart that I keep an eye on but don't post in every premium update. It was posted in today's update, #366. We plot Gold against foreign currencies (using the ETF UDN) and we plot Gold against the S&P 500. For Gold to get back into bull mode it needs to rise against all currencies and the S&P 500. If equities are outperforming Gold then no one will care what Gold does. Anyway, we can see that when priced against a foreign

currency basket Gold is at important resistance. Has Gold bottomed against the S&P 500? No one knows but if that ratio can advance through 0.75 then that it would be a strong bullish signal for Gold.

The next chart is one we shared a few weeks ago. It plots our 20-stock Junior Gold index in black and then the index against Gold in blue. We also include a 50-week moving average. I think 13 of the stocks are in the GDXJ which in my opinion is not a great junior gold index. It contains too many silver stocks, some companies I've never heard of as well as some stocks I wouldn't buy with your money.

Anyway our index has a median market cap of about $300 Million, so its smaller. It has all Gold companies and includes a good mixture of producers, developers and explorers. We didn't pick the 20 best or 20 strongest stocks. Four of the stocks declined 85% or more in the bear market. That is just after a quick check, there could be one or two more. The 50-week MA has done a good job of defining the trend, even going back in the years not shown. Note how the

moving average provided support for the ratio and is sloping up.

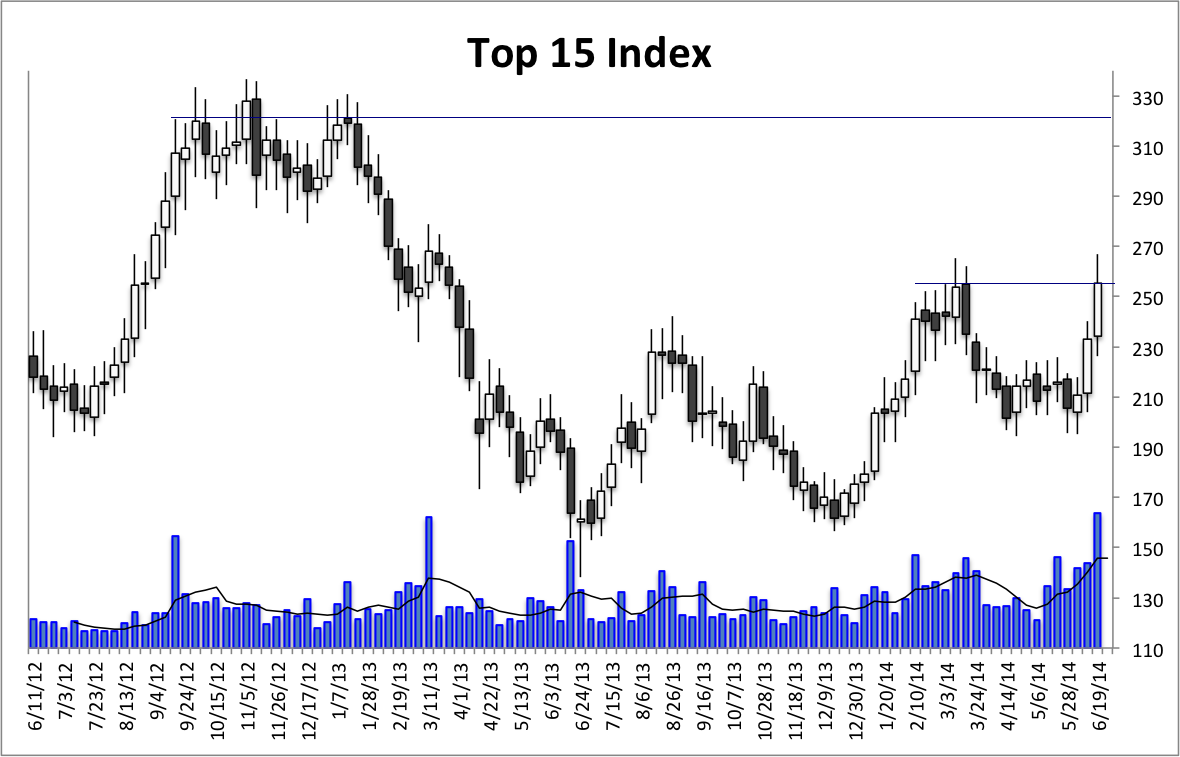

Our top 15 index contains 15 of our favorite companies in terms of fundamentals. It sold off Friday but managed to close (in weekly terms) at its highest level in nearly 15 months! Volume this past week was a record (the index dates back to late 2010) and 2-week and 3-week volume was also a record.

These charts were just a tiny part of our 30-page premium update #366. Some things we covered in the update (among other things) were what to look for in the COT reports in the coming weeks, the significance of the end of the month which is also the end of the quarter and finally how to go about adding positions and letting the market dictate success or failure.

The new brokerage portfolio is up 9%. We are transitioning from the model portfolio which including the 9% is up 26.4% YTD. Every position we own (now 10+) is at a profit. We bought the first three in May and were stopped out of two. One bottomed that day and the other bottomed the next week. Even in a bull market you have to follow your rules. The other position we bought was Bear Creek Mining which is up 96% for us. The good news is in a bull market the surprises are to the upside. Bear Creek is one case and another is Balmoral Resources which is at work with its Nickel

discovery.

The quality of our premium service is now higher and it is my hope and goal that subscribers will benefit. Of course, if we are in the early stages of a great bull market as I believe then that surely helps! To my knowledge there is only one other newsletter that has a real money portfolio to follow and his service is more than 5x the cost of ours. We publish a weekly update (usually 30 pages) with the information you need to know and not the

perma-bullshit that litters this space. We also are the only editor of a newsletter that is a credentialed technical analyst and we spend ample time reviewing company fundamentals. I appreciate my subscribers because their support allows me this labor of love. Click below to learn more about our service and watch the new video for details.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|