|

In this update...

- Editorial & Link

- Company News

- Premium Sample & Commentary

Editorial & Link

Editorial: Will We See Consolidation in Gold Mining Industry?

We discuss why we think consolidation will happen in two separate and different phases. The more exciting and aggressive phase is at least several years away while the first phase could begin in the coming months. The best juniors will be acquired while the weakest will inevitably die off.

Is this the Best Buying Opportunity in the Bull Market?

Rick Rule thinks so. This is notable because Rick knows this industry better than anyone and he wasn't bullish in 2011 or 2012. He was cautious then and thinks now is the time for "aggressive speculation" (provided you really know and understand what you are doing).

Company News

First Majestic Announces Q4 and FY 2012 Results

Argonaut Gold Announces 2013 Production Guidance of 120K-140K oz Au

Huldra Silver Receives $2.8M in Smelter Payments

First Majestic and Argonaut have been leading performers in recent years and those investors that missed the ball the first time around, may have a second chance. Their share prices have declined with the sector but remain above their 2012 lows (unlike many mining stocks). These news releases are important as they go into financials and production guidance for 2013. Meanwhile, Huldra Silver is working its way closer to declaring commercial production and Friday's release boosted the shares. It will be interesting to see if that marks a bottom in the share price.

Premium Sample

This past week was a very light week for premium updates as we were on the road meeting with a few companies to get a face to face update. These meetings actually gave me the inspiration for my editorial on industry consolidation, but that is another story.

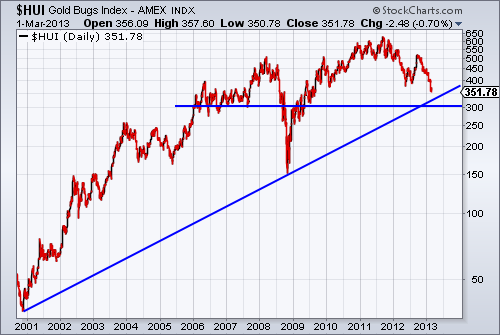

Although we put some money to work the previous week (10% of a 60% cash position) we remain 50% in cash and won't put further funds in until it looks safe. We have to admit that recent price action suggests more downside ahead. The HUI closed at 352 and has a strong confluence of support (trendline, retracements) at 337 and after that is 300 which stands out as support on the monthly chart.

In our update to be published this weekend we will consider where are favorite names may be trading at HUI 337 and HUI 300. We are very close to the end of this downturn but the most severe pain comes in the ninth inning. We may be in the 7th or 8th inning right now. That is why we will be very cautious when we put more cash to work. It's also why we've carried a high cash position for so long.

Gold continues to hold its 2012 lows yet various sentiment instruments are at 4-year lows and 7-year lows. This is extremely encouraging. Either the bull market is over or this will turn out to be a fabulous buying opportunity. In regards to what to buy, we'll discuss that in our upcoming premium update. There are two pieces of criteria we have which can immediately help solidify a list of candidates.

Click Here to Learn More & Subscribe

Wishing you good health and profits,

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence.

|