|

Here are the links of the week....

Precious Metals to Face More Body Blows

In this editorial we show the monthly candles for Gold & Silver as well as their bear analogs and a chart of the HUI Gold Bugs Index.

Corvus discovers potential high-grade vein shoot.

Only time will tell if this vein shoot is similar to the one at the nearby Bullfrog mine that contributed production of 300K oz Au.

Gold Recovery Analogs

Let's say Gold's weekly bottom occurs at $1050 three and a half months from now. What might a recovery look like? We use historical data to project a recovery.

Balmoral Resources continues to expand Nickel discovery at Grasset

Balmoral is certainly one of the best performing juniors this year. It will be interesting to see how the stock performs if metals continue to weaken. Sector weakness could create an opportunity.

Premium Charts- Precious Metals

We were faked out in early September but since then we've seen this coming. In the past few weeks we've urged subscribers to be as

defensive as possible as we thought that Gold breaking below $1200 and trading below $1100 was inevitable. We've focused on the bear analogs, pure technicals and the COTs to get a read on when and where this bear market will end. It is obviously close but its not here yet.

We've gone defensive in recent weeks and positioned ourselves to take advantage of the coming bottom. No one can call the bottom but we feel we have a good chance of recognizing the opportunity when it presents itself. We are simply using all of the tools at our disposal and waiting for when the odds are in bullish favor.

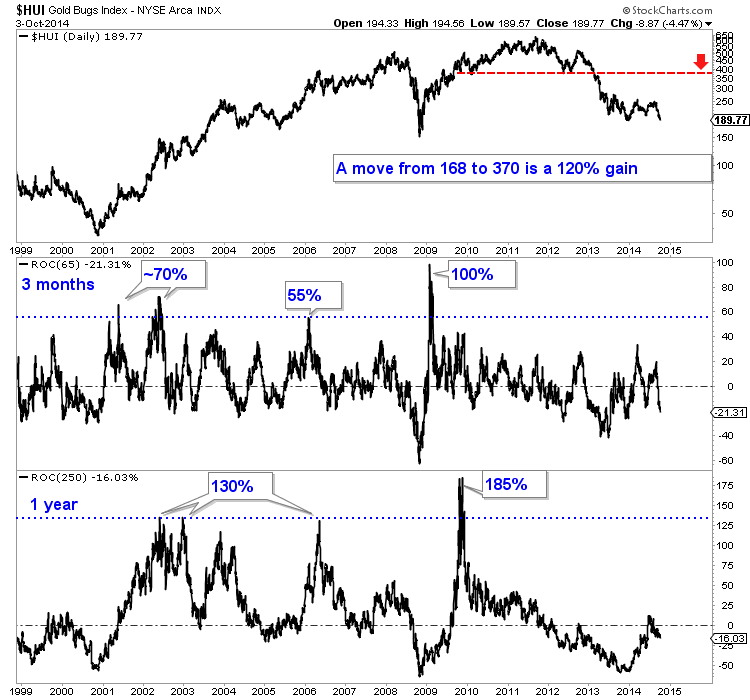

The HUI has major, 10-year support at 168. That is on a daily and weekly closing basis. The HUI can drop below 168 but we wouldn't expect it to stay there beyond a few days. The chart below plots the 3-month and 12-month rate of change for the HUI. Note that following lows, the HUI has consistently rallied at least 125% within one year. Following the late 2000 low the HUI rebounded nearly 300% in 18 months and following the 2008 low it rebounded nearly 200%

in 18 months.

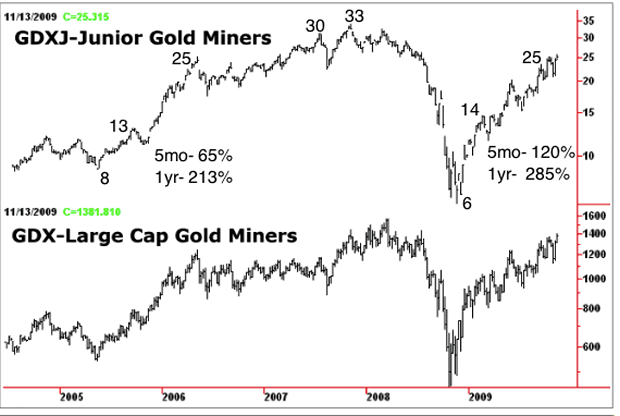

Bob Hoye re-constructed GDXJ (using its initial components) back to 2004. Following the 2005 and 2008 bottoms, it gained roughly 200% in the first year.

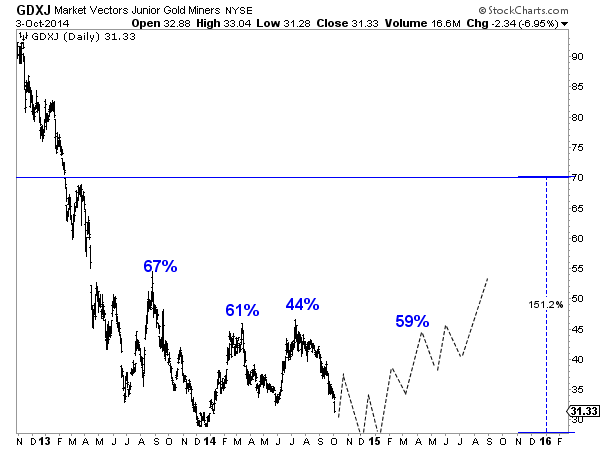

That type of gain seems impossible now but lets remember that GDXJ has had three short but sizeable rebounds since May 2013. The chart below shows a rough projection. GDXJ has already proved it can rally 60% in a short period of time. If and when it swings back to a bull market all it needs to do is sustain that strength. In other words, it could rally 59%, consolidate for a few months and then break above

$45. If it does that then its on its way to a massive rebound in percentage terms.

Over the past few weeks we positioned ourselves to take advantage of this final decline. Huge gains are made possible by the selloffs we are seeing now. Tack on another 20% decline and you can envision how specific stocks can rebound strongly in a short period of time.

Consider a subscription to our premium service as I believe we have one of the best services available. We are the only credentialed technical analyst who is the editor of a service. Secondly, we are one of only a few people who run a real money portfolio. That means our goals are 100% aligned with our

subscribers.

Upon signup you will immediately receive all recent updates and important reports. In the past few weeks we've published a Top 5 Stocks report, a Long-Term Precious Metals Outlook Report as well as a Global market update. This is in addition to our weekly updates. Our top 5 report covers our top 5 stocks to buy at the coming bottom. The Long-Term Outlook report is a 36-page report which contains a bevy of actionable charts

and information. You won't be disappointed with this material.

We have three goals: to help subscribers make money, to provide some education and to produce the highest quality research and analysis we can. We work really hard to deliver a top notch service.

Thanks for reading. I wish you all great health and prosperity in 2014 and beyond.

-Jordan

Disclaimer: Sponsor Companies are paid sponsor companies of TheDailyGold.com website and this free newsletter. Do not construe sponsorship with a recommendation. The author of this newsletter is not a registered investment advisor. This newsletter is intended for informational and educational purposes only and should not be considered personalized and individualized investment

advice. Investment in the precious metals sector contains significant risks. You should consult with an investment advisor and due your own due diligence before making any investment decisions. This email may contain certain forward looking statements which are subject to risks, uncertainties and a multitude of factors that can cause results and outcomes to differ materially from those discussed herein.

|

|