|

|

October 18, 2022

Subscribe to Mining Memo

|

|

Mining Market Update

|

| Price |

$19,370 |

▲1% |

| Hashrate |

259 EH/s |

▲20% |

| Difficulty |

35.6 T |

▼13% |

| Revenue* |

$0.0702 |

▼20% |

|

|

|

|

|

September Public Mining Updates: Argo, Marathon, Iris and More

|

|

September mining proved to be a challenge for many miners. Not only did miners have put up with a large increase in Bitcoin’s difficulty, but inflation-goaded energy prices continue to eat into miner’s bottom line.

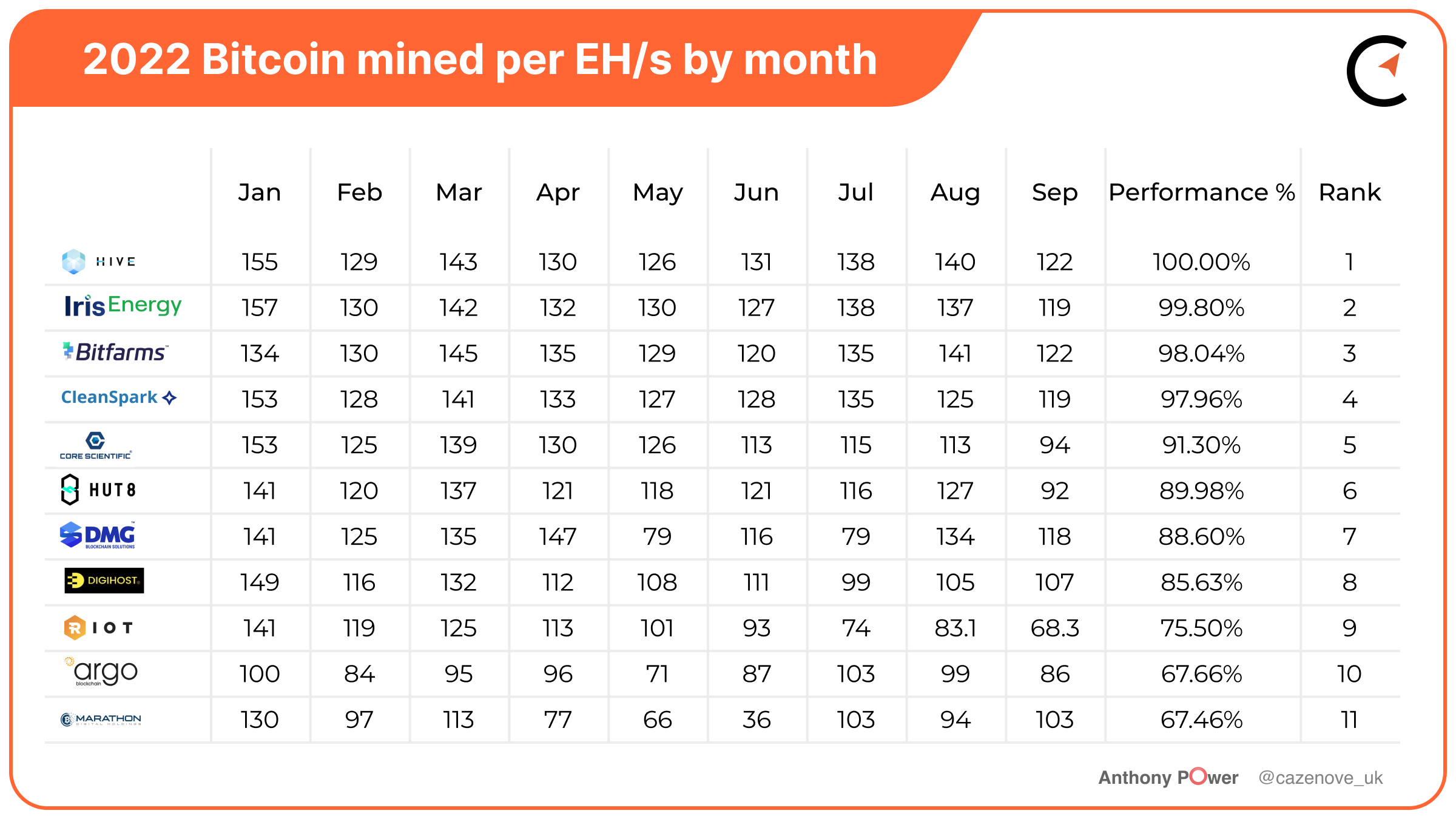

Bitfarms (BITF) beat out Hive Blockchain by the smallest of margins in terms of overall operational mining performance by EH/s, followed by Iris Energy (IREN) and Cleanspark (CLSK). Notable miners include DMG Blockchain, with an increase its daily average Bitcoin

production by 15.3%, and Marathon Digital doubling its daily production rate in September.

|

|

| Year-to-date, the top position has again changed with Hive Blockchain now edging out Iris Energy as the most consistent operator by EH/s. Overall, the top four miners appear to be creating a gap with their consistent operational updates. |

|

Continue reading

here.

|

|

|

|

|

Argo Blockchain takes action to strengthen its balance sheet

|

|

Argo raised some $111 million after going public a little over a year ago. A deepending bear market and difficulty getting units online has changed the miners metoric trajectory. We take a look at Argo's financial moves since.

|

|

|

|

|

Get Tickets Today For The Texas Blockchain Summit!

|

|

The Texas Blockchain Summit is back in Austin, Texas, Nov 17-18! The premier event will bring policymakers, Bitcoin miners, and recognized influencers to discuss Bitcoin, blockchain and crypto space.

|

|

|

|

Mining News Feed

|

|

Bloomberg / EU Puts Bitcoin in Crosshairs With Crypto Energy Labeling Plan

|

|

|

|

Northern Data / Northern Data Parts With Chief Operating Officer

|

|

|

|

The Block / Digihost is latest bitcoin miner stock to face delisting, trading below $1

|

|

|

|

CoinDesk / A Huge Glut of Bitcoin Mining Rigs Is Sitting Unused in Boxes

|

|

|

|

|

|

|

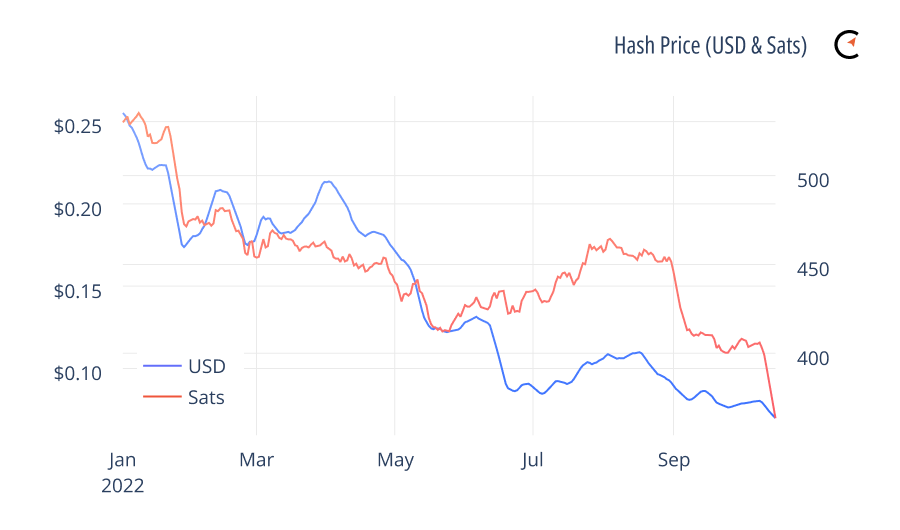

| Hashprice, a value for the revenue generated by Bitcoin miner's per unit of hashrate, fell below $0.07 after the lastest difficulty adjustment. Hashprice valued in sats also fell, collapsing below 400 satoshis. |

|

|

|

|

|

The 2021 bull market saw a surge of hashrate hit public markets. Months later, most of those miners face their first bear market, backed by unfamiliar retail investors. We take a look at who is performing, who's in trouble and what equities might be worth paying

attention too.

|

|

Watch on YouTube here.

|

|

|

|

|

|

| Ebang |

9.33% |

$0.34 |

$2.42 |

| Riot Blockchain |

0.91% |

$6.30 |

$46.28 |

| Hut 8 |

0.77% |

$2.04 |

$16.57 |

| Cleanspark |

0.01% |

$3.26 |

$23.60 |

| Bit Digital |

0.01% |

$1.08 |

$14.25 |

|

|

*As of Tuesday, October 11th

|

|

|

|

|

About Compass: Compass is a Bitcoin mining and modern media company focused on driving the mass adoption of cryptocurrency mining.

|

|

|

|

Did a friend forward this email? Sign up here.

Want more Compass content?

|

|

|

|

|

|

|