|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold's Fundamentals Not Bullish...

Published: Wed, 12/15/21

|

|

|

It's difficult to have to write stuff like this but that's probably why you are reading this.

After the Gold crash of 2013 I had to step back and really learn what moves the market. And still, it's a very tough market to trade or time. I've seen the absolute best technical analysts get completely fooled. But I digress. I'm sorry but Gold's fundamentals are not good right now. Real yields are starting to break higher and Gold & Silver have just broken down to new multi-year lows relative to the S&P 500. Read more about that here If you want to hear a similar analysis (in audio form) then click below. In this interview we discuss disinflation, Silver, real interest rates and the other nitty gritty of Gold's present fundamentals. Click Here to listen For more on Gold's fundamentals, here is Steve Saville's take. ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

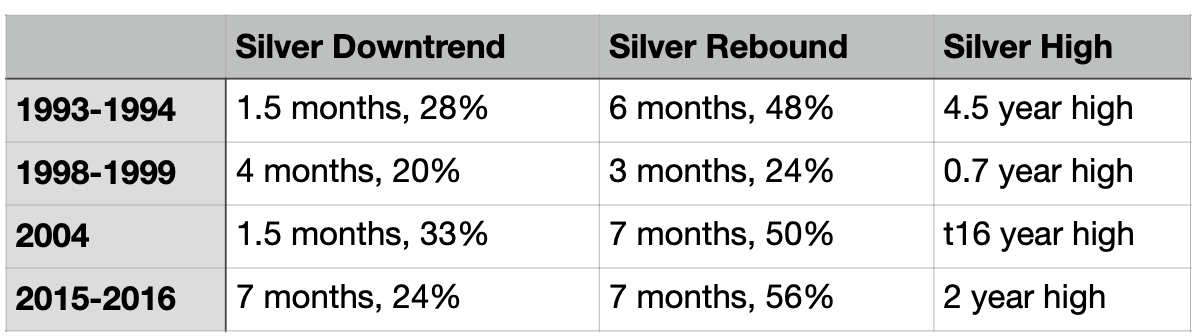

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- I've written about the start of a Fed rate hike cycle being a catalyst for Gold, but the data is even more supportive of that for gold stocks and Silver. Here is the data for Silver over the last 4 rate hike cycles. The downtrend is the decline before the low around the actual rate hike.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

In TDG #755 we commented on the odds of success for each of our holdings. It's an important criteria I factor into my decisions. (In addition to cutting losses when they exceed 20%). I also wrote about the economic outlook over the next year and into 2023 and how this could impact Gold. The Fed is going to hike. The question is when and what happens after. Those questions will help us assess 2023 as well. We have to assess the probabilities along with the technicals and sentiment. Gold is pointing lower and perhaps it gets extremely oversold and hated around the time the Fed hikes. That would lead to a big rebound. Finally in TDG #754, in Q&A we mentioned a junior silver company that is setting up to be a future leader. Silver's outlook is not good until that rate hike- which could lead to a big rebound. -------------------------------------------------------------------------------------------

|