|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Has Bullish Catalysts Coming....

Published: Thu, 01/27/22

|

|

|

Federal Reserve comments among other things pushed precious metals sharply lower on Wednesday. The pre-rate hike decline remains a possibility.

However and more importantly, the fate of the universe (economy & markets) could be shifting under the surface and towards Gold. I explain below. Read my article about the bullish catalysts coming One interesting development in recent years is how Gold & Silver have been somewhat negatively correlated to inflation expectations. They have actually performed better amid falling inflation expectations, than rising inflation expectations. I explain in the video below. Declining Inflation Expectations & Impact on Gold & Silver ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

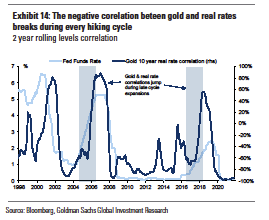

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- Gold & Real Rates During Fed Rate Hikes The fundamental driver for Gold is declining real interest rates. That's abundantly clear over 100 years of history. However, as this chart shows (apologies for poor quality), Gold's correlation to real rates actually rises during a cycle of Fed rate hikes. One case was 2005-2006 when Gold exploded. Real rates were not falling then. Same in 2017 though the falling dollar helped Gold. Real rates have broken out to the upside and for now Gold & Silver have held up. In any case, this info aligns with my view that the metals will rebound after the first hike (coming March 2016).  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

In TDG #762 we sketched out what we want the model portfolio to look like come spring. We put this info in a table: company name, portfolio weighting & a few comments. #762 is the best update since I became a subscriber, in terms of writing in detail about things that I had been thinking about all week. -------------------------------------------------------------------------------------------

|