|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Will Bear Market & Recession Takedown Gold & Gold Stocks?

Published: Thu, 04/07/22

|

|

|

To answer the question in the subject line, it's unlikely.

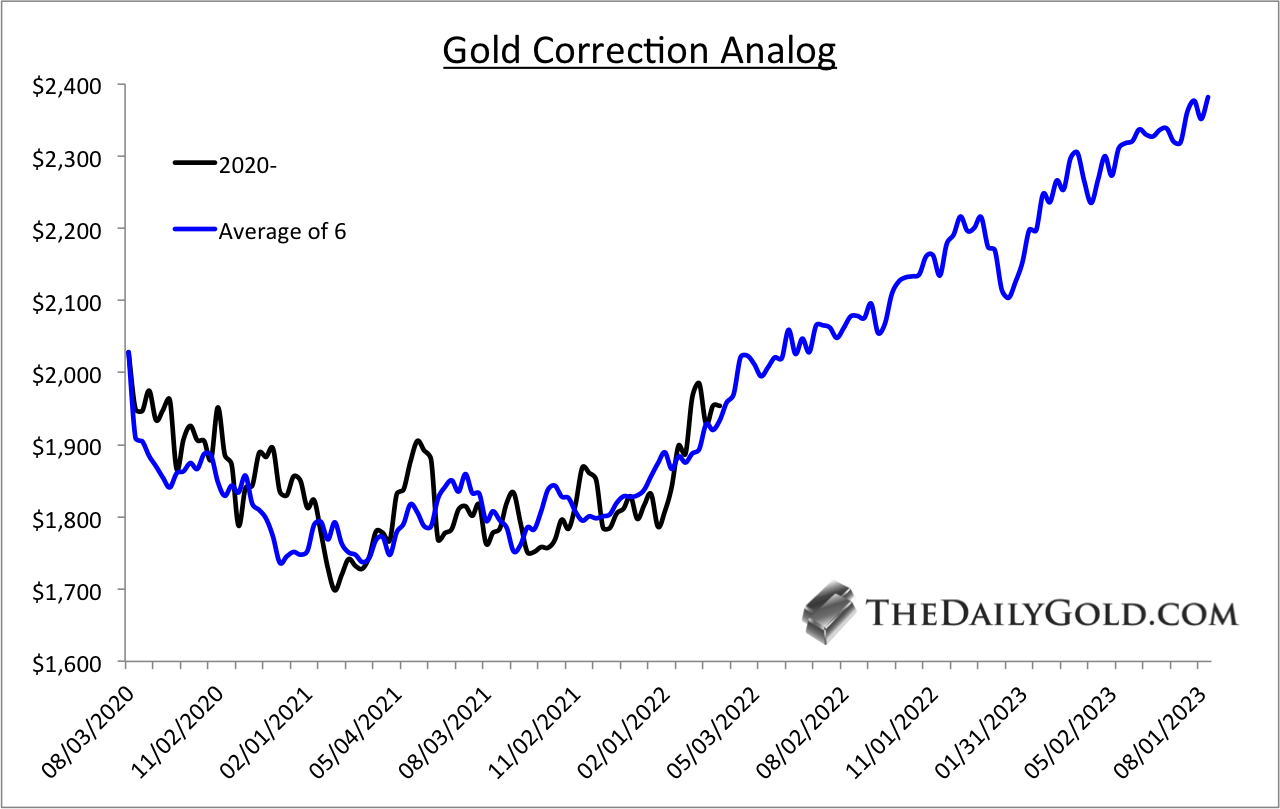

In fact, the recession & bear market to come is likely what gets Gold to go my $4,000 target before 2025. I analyze the question, the history & more in this video... Click Here to See the Video Meanwhile, the correction in precious metals continues... How long will this last? What are support levels? What will end the correction and push Gold past $2,100? Check out my article, penned yesterday. Click Here to Read the Article ------------------------------------------------------------------------------------------- This chart shows Gold's average performance during & after a correction in a bull market.

Gold is following the average quite closely, but I do think once it clears $2,100, it will accelerate faster than the blue line.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|