|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Silver Stock Breakout & 2 Great Interviews....

Published: Fri, 04/15/22

|

|

|

The gold and silver stock indices continue to lead and continue to outperform. I thought their bullish consolidations would continue...

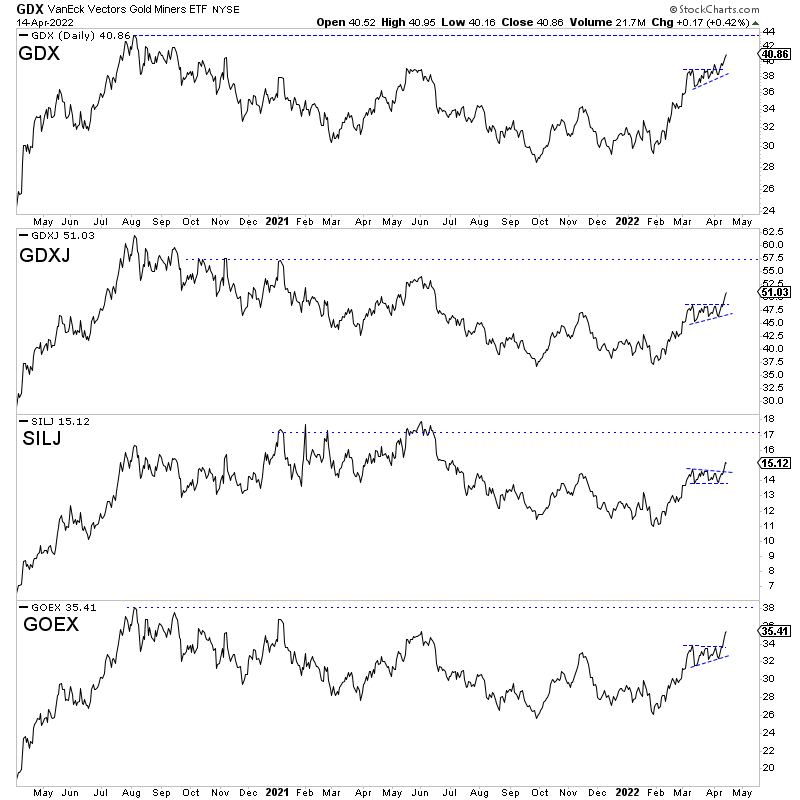

But the mining indices & ETFs (GDX, GDXJ, SILJ) broke out from bullish flag patterns. (Scroll down to see the chart). Moving on... Gold-bug land can be a bit like a cult because many of us think alike, sound alike and have the same predictions. Where's the variety? I'm always looking for people to interview who have a different perspective. If that is your cup of tea, you might find these two interviews valuable... The following gentlemen has kept a low profile over the years and has not done any interviews. I've found him to be one of the absolute best guys to follow with respect to Gold's fundamental backdrop as well as market timing. Click Here to Listen to the Interview Next, I interviewed Brent Johnson who gets ire from gold bugs because he is a big US Dollar bull. But he's a gold bull too. His primary view is a global sovereign debt crisis is in our future and Gold and the dollar will benefit. Click Here to Listen to the Interview ------------------------------------------------------------------------------------------- Here are the daily line charts for GDX, GDXJ, SILJ and GOEX (gold explorers ETF).

They have broken out from bullish flag patterns. Targets were given to premium subscribers last weekend, prior to the breakout. This move could reach the horizontal blue lines before a meaningful pullback.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|