|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Nothing More Bullish for Gold Than Strong Dollar...

Published: Thu, 08/18/22

|

|

|

Brent Johnson of Santiago Capital made the above statement.

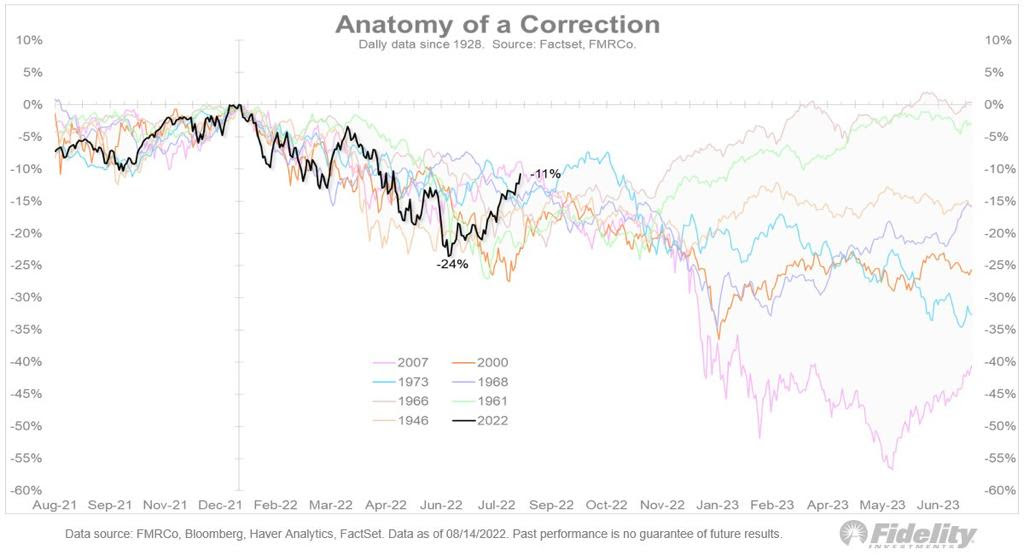

If you are not familiar, he is one of the biggest dollar bulls around. But he's also super bullish on Gold. Click Here for My Interview with Brent Last week I wrote an article explaining what I term the Gold cycle. There are certain points within the economic cycle when Gold and gold stocks perform best (and not so well). Click Here for the Article ------------------------------------------------------------------------------------------- This analog chart plots four of the six worst bear markets (ex 1937 & 1929) as well as declines after 1946, 1961 and 1966.

The S&P 500 tested the 200-day moving average exactly 7.5 months into this decline. That 7.5 months figure was the average/median test of the 200-day moving average in the 6 worst bear markets. But the market is showing good enough breadth which argues this run could continue. On the other hand, the yield curve (10-year and 2-year) is inverted. Over the past 70 years, an inversion has preceded 11 of the 10 recessions. Only once did the signal miss.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|