|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Next Move in the Bear Market & Impact on Gold....

Published: Thu, 09/22/22

|

|

|

The S&P 500 has continued to trend lower after failing at its 200-day moving average last month.

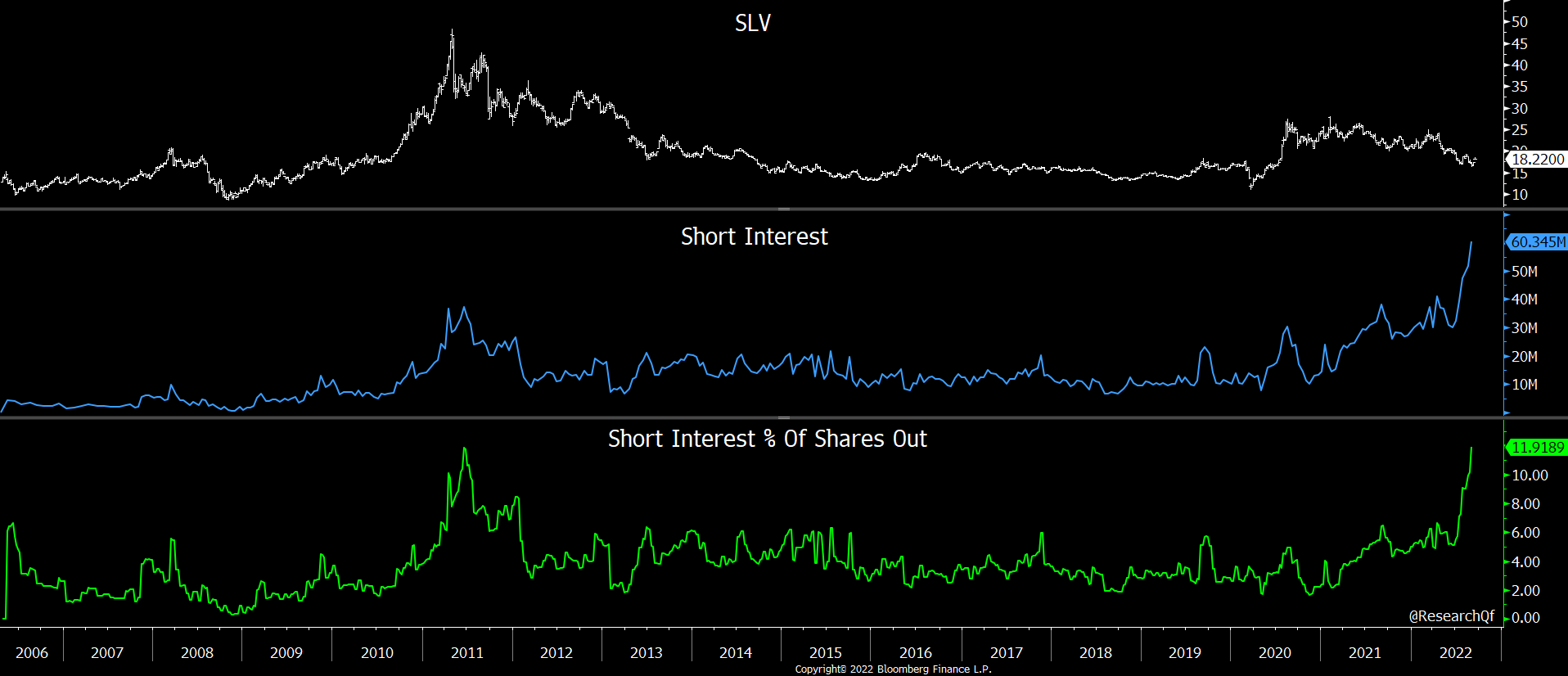

It is now less than 2% from breaking below its 40-month moving average, which is an incredibly important level. Historically, what happens after the market fails at its 200-day moving average? How soon might it break the 40-month moving average and break to a new low? Click Here for My Video Analysis. We know that Gold is breaking down technically. But thus far this breakdown has not been confirmed by Silver, the gold stocks or the Gold to S&P 500 ratio. The next 10 days will be very interesting. I explain in this article. Gold Breaking but Multiple Non-Confirmations ------------------------------------------------------------------------------------------- This chart shows the Silver ETF, Short Interest and Short Interest as a percentage of the shares outstanding, which is also at an all time high.

The net speculative position in Silver as of a week ago was at its 2nd most bullish reading EVER. And now the short position is at a record high. It surged higher in recent months and Silver only dropped slightly.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|