|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Top Market Timer Expects Reversal in Gold Stocks.....

Published: Fri, 07/22/22

|

|

|

In terms of gold stocks, Larry McDonald has been one of the two best market timers I've seen over the last 20 years.

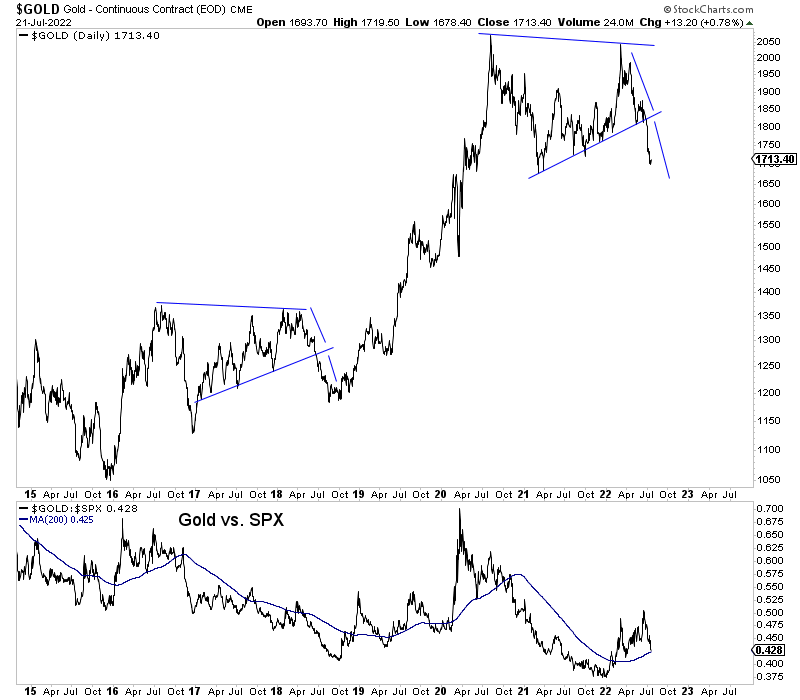

Click the link below to listen to our interview. His audio is not great so turn up your sound. Also click "CC" for captions. As an aside, I watch tv shows and movies with the captions and you pick up more than you would think. Click Here to Listen to Interview The stock market is on course with the historical template of some of the worst bear markets in history. Watch the video to learn some history and what to look for over the coming months. Click Here for the Video ------------------------------------------------------------------------------------------- There are some key technical similarities to 2018. Both times Gold broke down from a trendline (tested more than a few times) as the Fed was close (but not done) with its hiking cycle.

This breakdown is more significant because it projects to $1600, which is a lower low. There is more technical damage this time. Gold really took off in December 2018, which was the Fed's last hike.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

The gold stocks are arguably the most oversold since the 2016 low or in some respects, since the end of 2014. Based on the breadth indicators GDXJ is the most oversold in nearly 8 years and GDX/HUI are not too far behind. The miners have stabilized in recent days and so have most of our stocks. The path of least resistance is higher in the short-term..... On the macro side, various indicators are signaling echoes of 2008 and the Covid crash, while the market anticipates Fed rate hikes until the end of the year. If something breaks in the next 60-90 days (which is more likely than not), the Fed will be forced to shift course and ease. That means July or September should be the last hike. -------------------------------------------------------------------------------------------

|