|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: When Will Gold Decouple from Stock Market?

Published: Fri, 10/21/22

|

|

|

The bear market in stocks has been following the path of the six mega-bears (all during secular bear markets). Gold (or gold stocks) decoupled from the stock market (before the bear ended) during five of the 6.

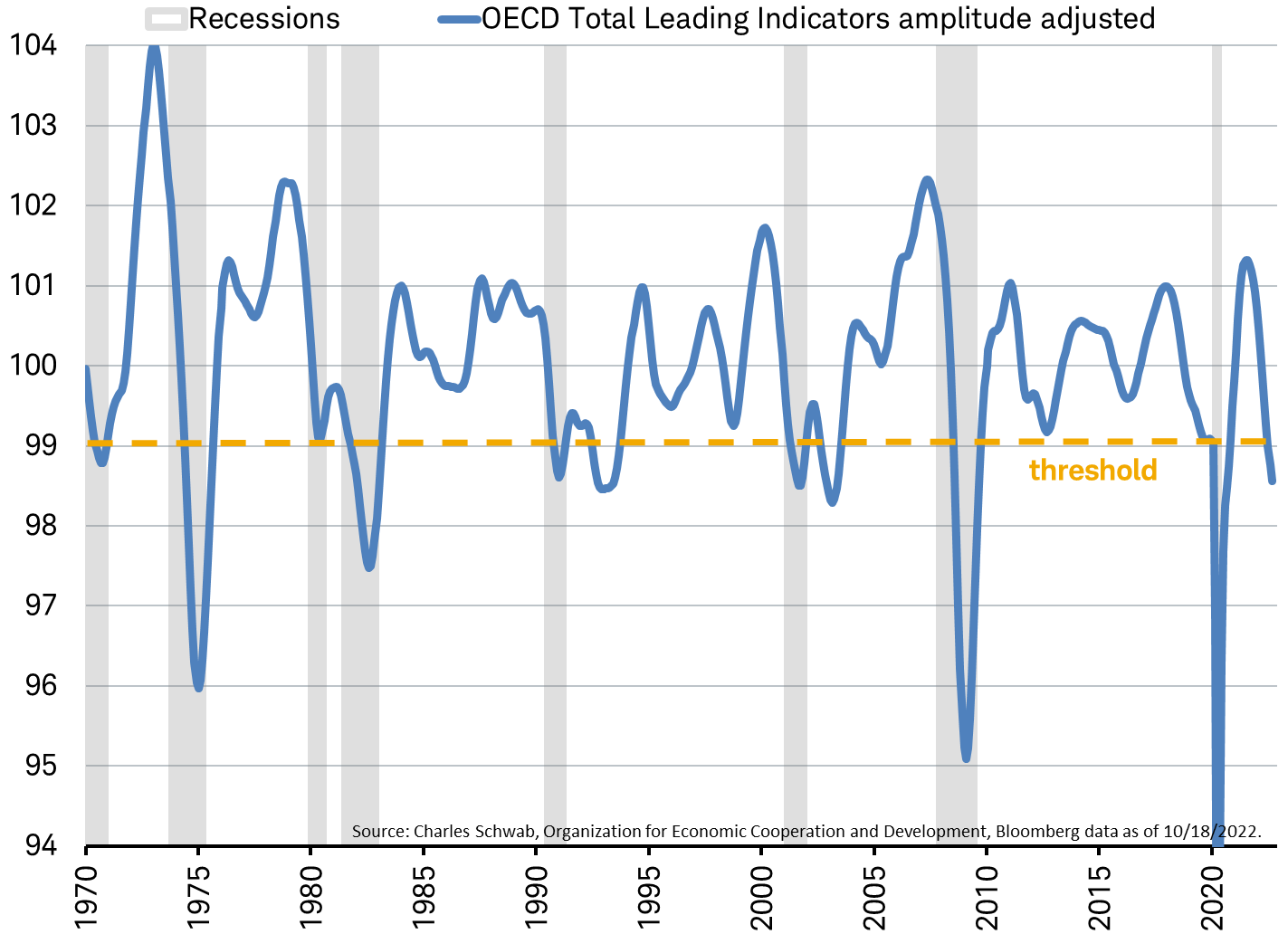

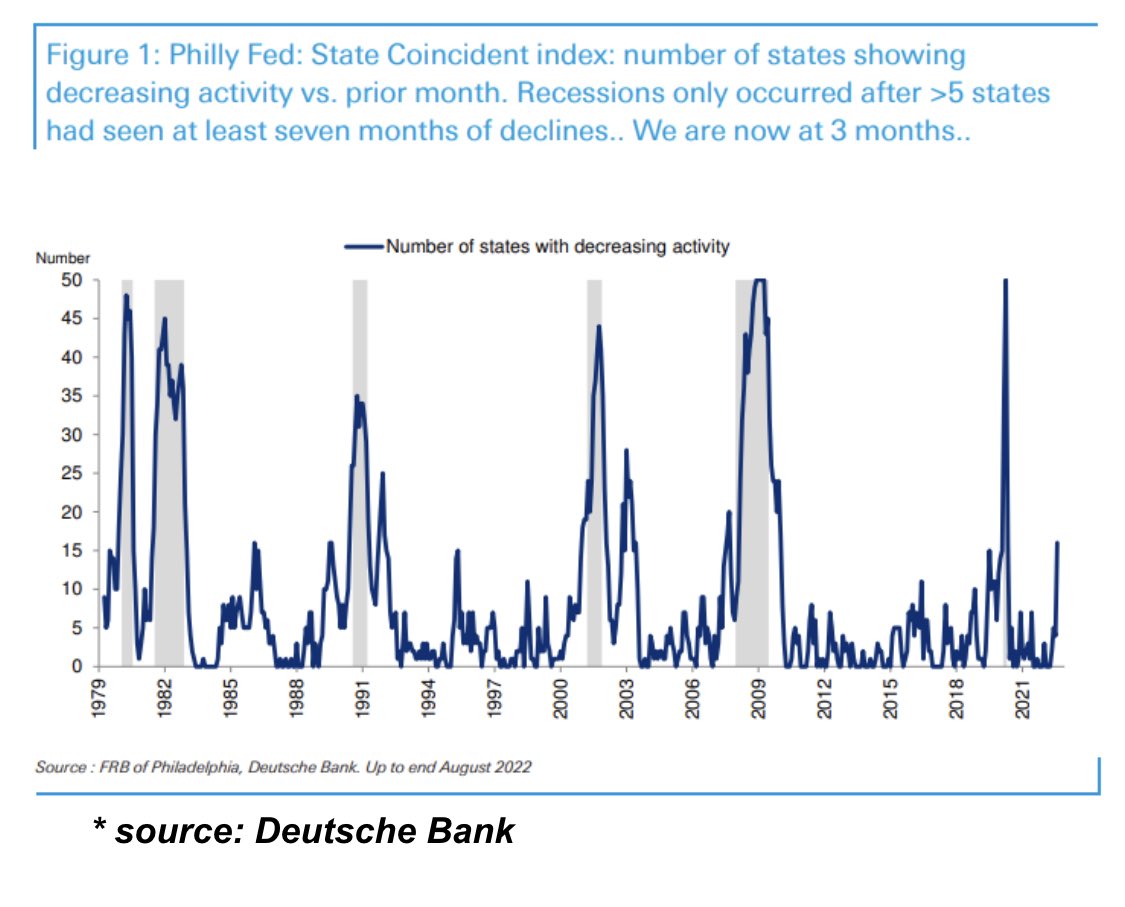

If we focus on the most recent 4 mega-bears (which began in 1968, 1973, 2000 and 2007), Gold or gold stocks began the decoupling no later than 11-12 months into the bear market. At present, we are a week from being a full 10 months in. Click Here for My Video Analysis There are quite a few reasons to think this is the start of a secular bear market in stocks. I've mentioned most of them. But there's one I have not mentioned. Click Here for My Video Analysis ------------------------------------------------------------------------------------------- These two images show the risk of an imminent recession....

First is the OECD leading indicators. When this falls below 99, as it has, a global recession is imminent.  This chart shows the number of states with decreasing economic activity. The number (15) is around where it was in the mid 1980s and mid 1990s when there were soft landings, triggered by Fed rate cuts. The Fed will cut rates but it's not going to be soon enough to forestall a recession.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

-------------------------------------------------------------------------------------------

|