|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Bulls: Stop Fearing 2008 Boogeyman

Published: Thu, 04/27/23

|

|

|

Gold is on the cusp of its biggest breakout in 50 years and the start of a new secular bull market.

Yet some are overly concerned that there will be a repeat of 2008. I share my thoughts below. Article: Stop Fearing 2008 Boogeyman Wednesday I did my weekly interview with KEReport. I shared my latest thoughts on Fed Policy, Recession, Gold, 2018 comparison, etc. I argued why there will be no Fed pause this cycle. Interview: Fed Will Shift Quickly A possible "triple top" in Gold is another worry that can be added to the proverbial "wall of worry." There is no triple top. Video: No Triple Top in Gold Nevada King Gold is a sponsor of this free newsletter. The company discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. PREMIUM SUBSCRIBERS ARE UP 43% FROM THE FIRST BUY -------------------------------------------------------------------------------------------

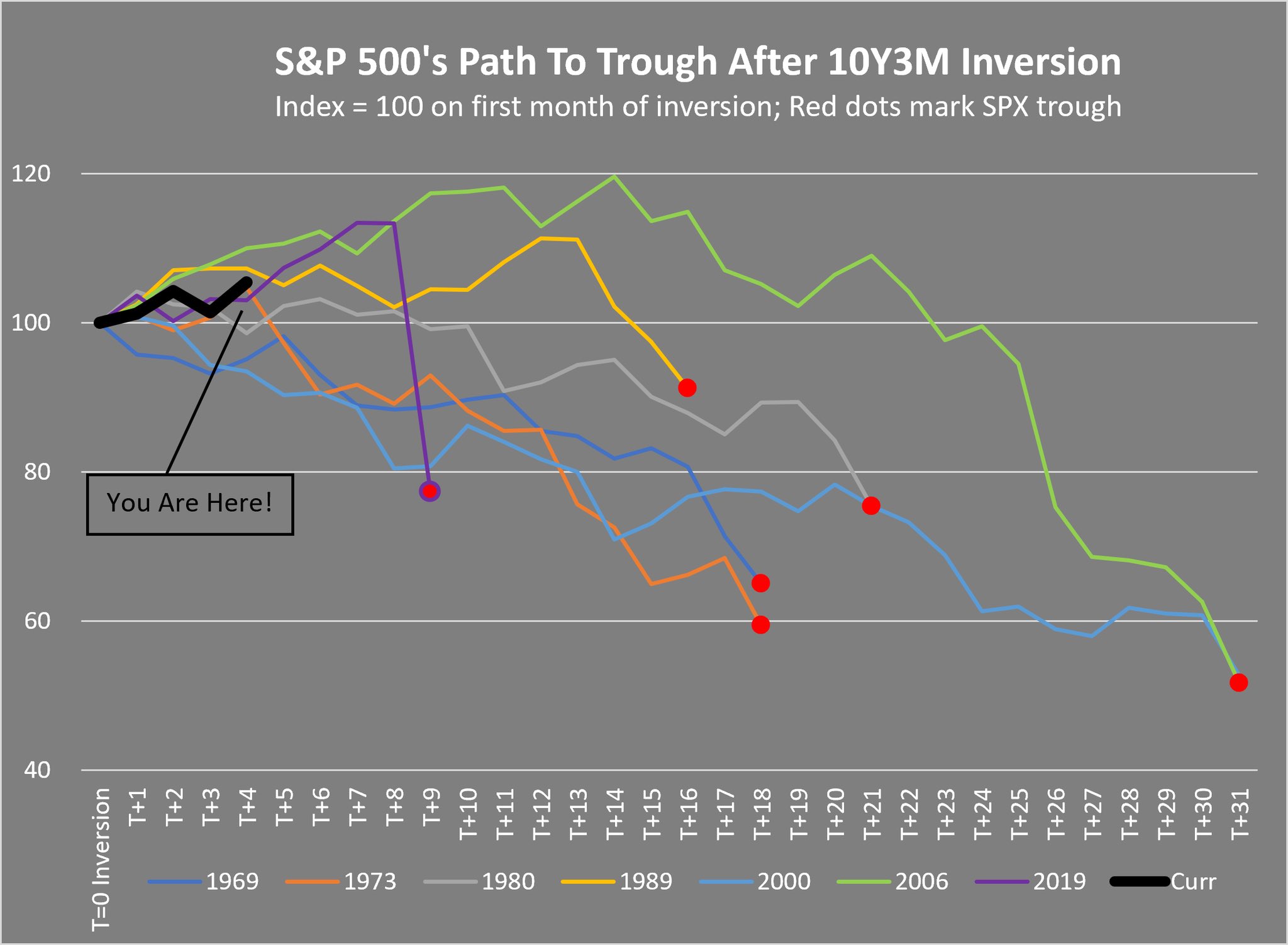

This chart plots the performance of the S&P 500 after the 10-year yield and 3-month yield spread inverts. (3-month yield exceeds 10-year yield).

The red dots mark the bottom of the S&P 500. The bottom scale is the number of months. All but one dot would argue the bottom is 12 to 16 months away.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... Here is part of the executive summary from TDG #827: This update includes, among other things, company news from a handful of companies as well as Q&A on another handful of companies. The top 10 table is updated with notes pertaining to recent performance and support/resistance levels. In the model portfolio spreadsheet we show the close, support and then a buy/accumulate/hold rating. The precious metals sector corrected last week and I anticipate we could see more selling, but not too much. Gold closed the week at $1990. It has support at $1950 and $1900, which would be an 8% correction. GDX and GDXJ corrected 8% and 10% already and another 5% down would take them to a good support range. Even after this weakness, 88% of HUI and GDXJ stocks remain above the 50-dma. Breadth and momentum remain very strong and a bit more time or selling is required for the miners to cool off. Corrections in GDX after the 2016 and 2019 breadth thrusts ranged from 8% to 17%. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options