|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Two Roads for Gold. Both are Bullish....

Published: Fri, 03/10/23

|

|

|

There is no soft landing when inflation is at 4%. It's still at 6%.

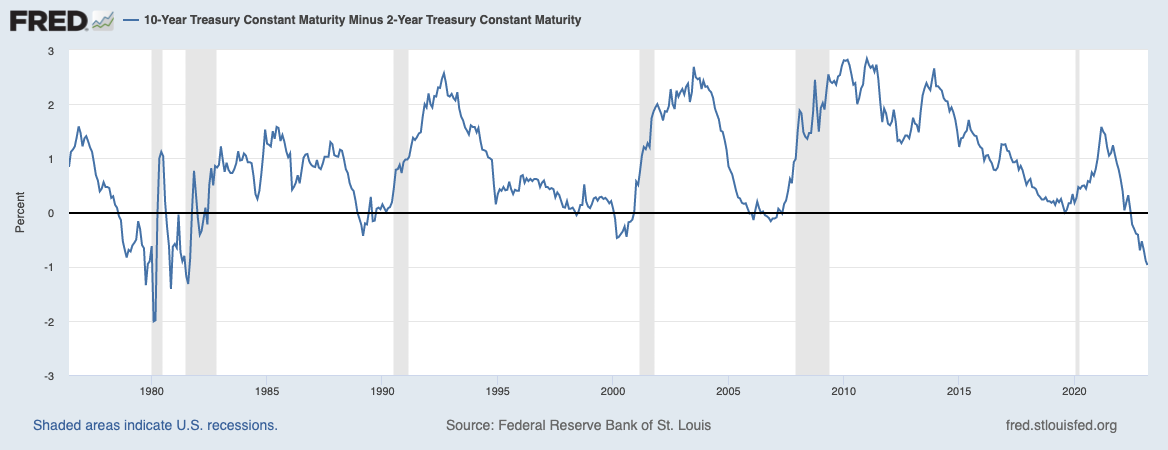

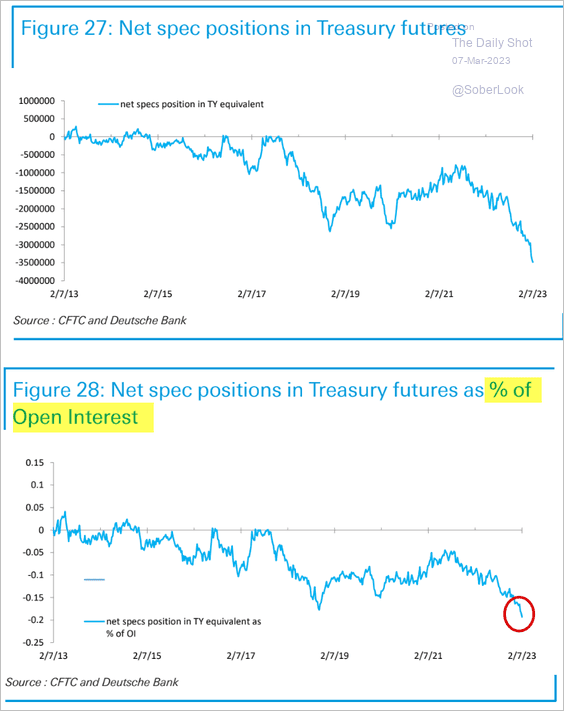

We either kill inflation with a very hard landing (recession) or we get a soft landing or mild recession, which becomes stagflation a year later because inflation accelerates. Both outcomes are bullish for Gold and perhaps that is why in the very big picture Gold has held up well given the second most severe Fed tightening in history. Click Here to Read My Article I just published a video with an update on the stock market. Risk is rising due to potential contagion from the banking sector, which looks bad technically. This has important implications for the stock market and the Gold/S&P indicator. Click Here for the Video ------------------------------------------------------------------------------------------- This chart plots the yield curve (10-year less 2-year yields) with recessions in gray. Recent history shows that recessions occur several months after the curve begins to steepen (blue line rising after it falls below 0). Note, during the double dip recession of 1980-1982 (which was caused by Fed tightening), the recessions began when the curve began steepening.  The yield curve steepens when the 2-year yield (which is a proxy for the Fed Funds Rate) begins to decline. Bond yields have been rising and Bonds have been selling off. However, the positioning against Bonds is quite extreme. When the market begins to sniff recession, the move into bonds will have some serious staying power. (And that will be good for Gold).  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #819 we published an intro report on a new top 10 company. This company has a current market cap of under US $200 Million and a project that should have an NPV close to $1 Billion if metals prices were a smidge higher. The NPV is easily more than $1 Billion at $2000 Gold. We think it will be acquired in 12 to 24 months. If the gold stocks and Silver continue to trade lower towards 2022 lows and that occurs while the stock market loses its 40-month moving average and the Gold to S&P 500 ratio rises, I will become very bullish and put my remaining cash to work. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options