|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Stocks Approaching Resistance....

Published: Wed, 10/27/21

|

|

|

The gold stocks have had a good rebound but are now approaching technical resistance.

GDX, GDXJ and HUI all have come very close to their 200-day moving averages. Their 400-day moving averages are a few % higher. HUI 280 and GDXJ 47 are key levels that date back to 2013. GDXJ traded up to nearly 46 and HUI to nearly 270. Meanwhile, Gold is struggling around $1800. It has monthly resistance around $1825 and weekly/daily resistance at $1830-$1835. Its 200-day and 400-day moving averages are at $1795 and $1818. So the sector is going to be testing these stiff resistance areas. Here is a video published Tuesday analyzing the current technical outlook for Gold. Moving along... Unless the stock market corrects significantly over the next few months, then we can expect the coming Fed rate hike to be the next catalyst for precious metals. The market is now pricing in a 40% chance of 3 rate hikes next year. Also, as of Monday, the market was showing a 38% chance of the first rate hike in May. That's roughly 6 months away. Over the past 50 years, there have been 8 rate hike cycles. The start of 6 our of 8 marked an important low in gold stocks. (In one of the other two the low occurred 9 months before the hike). Click here for my video and this bullish analysis. Finally.... Bitcoin & crypto is not negatively impacting the Gold market. What?! Why not? It's not trading like a currency alternative or an inflation hedge. You really own a leveraged play on the stock market or technology. I explain in this video ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

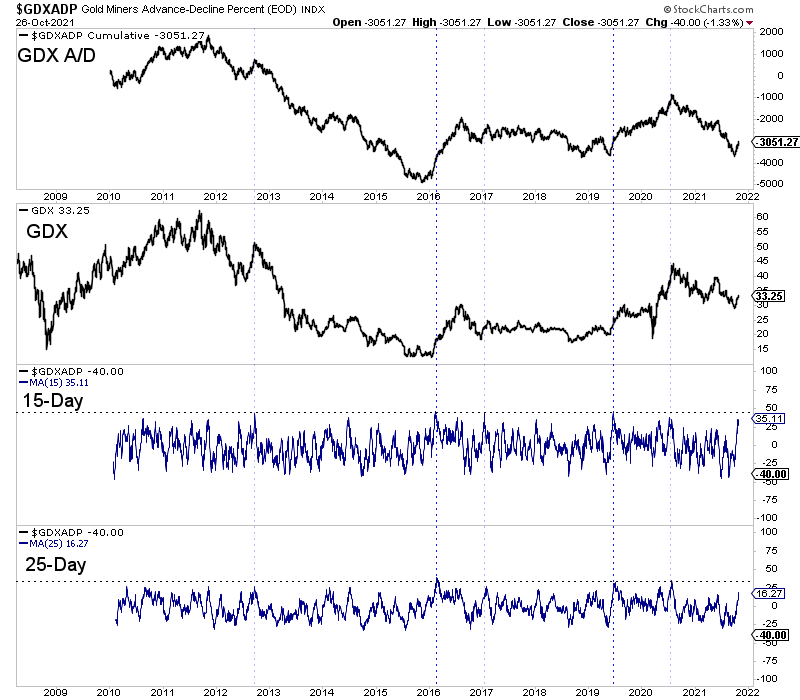

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- Here is a chart measuring potential breadth thrusts in GDX. A breadth thrust can occur after a bottom and sometimes before tops. Essentially a breadth thrust is when a market or sector shows a sudden burst of very strong and widespread participation. In other words, a breadth thrust in GDX would entail every stock within GDX rising in unison. This data is free on StockCharts.com and you can play around with the time periods. I'm looking at the movement 15-day and 20-day advance-decline line. Note, the strongest thrusts were clearly after the 2016 and 2019 lows. If GDX were to push through the aforementioned significant resistance, it might signal a similar breadth thrust. But it has to happen quickly. Thrusts only happen quickly.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

TDG #749 (last weekend), consisted of lengthy Q&A in which I covered how to assess drill results, the silver stock universe and how/when to sell. Interestingly, my strategy for investing in gold companies is different than with silver companies. In other words, I tend to look for a different type of junior in silver. TDG #749 also included my buy call on one of my favorite companies. The stock has held up fairly well but was still 25% off its high. In a previous company report, I calculated the potential stock price for the company in 3 years, at $2100 Gold. From today's price, that's almost a 7-bagger. Assuming a breakout in Gold, the stock has 10-year potential. The stock is liquid and even if Gold were to trade at $1700-$1800 for the next few years, the stock should move higher. In TDG #748 I added another company to my watch list. This company is a producer and they have had excellent drill results at two of their projects! I deem it the Holy Grail. That's when a producer has significant value-adding exploration results. The producers that have made the biggest moves in the past 5 years are the ones with the most exploration success. -------------------------------------------------------------------------------------------

|