|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold on the Cusp of Historic Breakout

Published: Tue, 03/28/23

|

|

|

Gold is coming to the end of its cup and handle pattern and secular bear market.

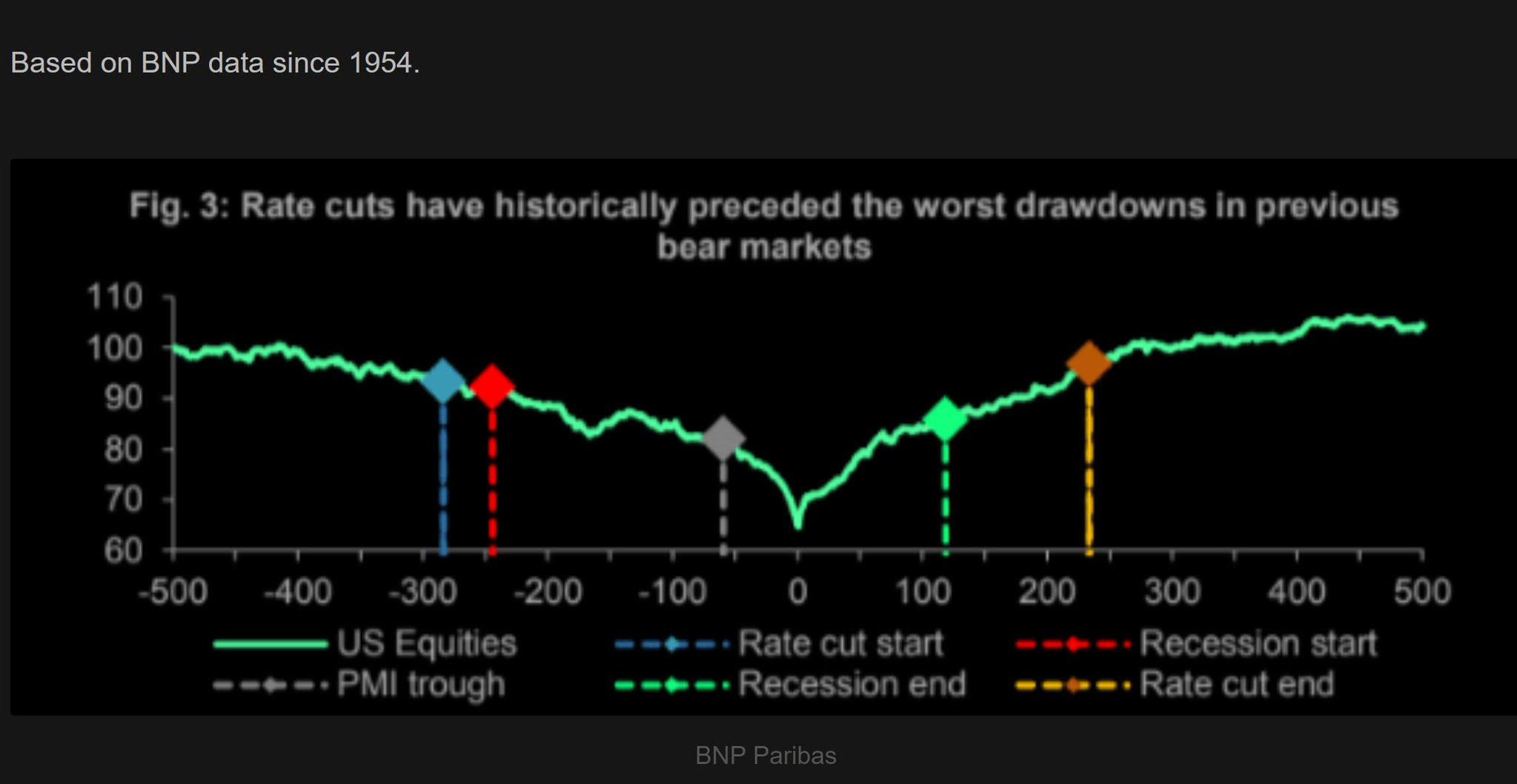

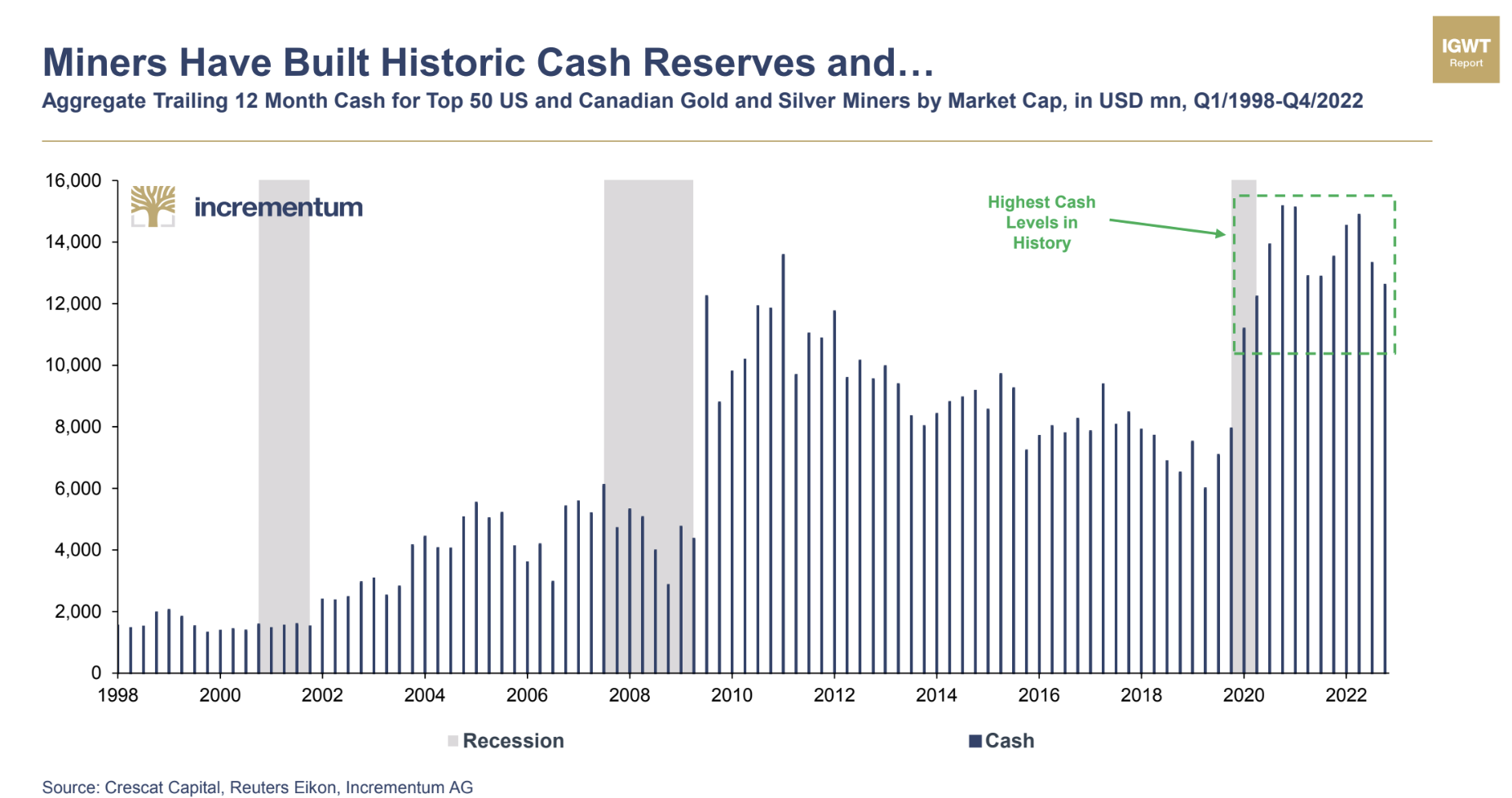

A truly historic breakout is coming. But first, Gold faces monthly and quarterly resistance this week (at $1953 and $1985). Maybe the market needs more time. Whether it happens in the coming days or later this year, it will be an important inflection point in history. Think of the breakout in US stocks in 1982. It could resemble something like that. Alright, so Gold is going much higher. Great. When are those damn miners going to move? How about Silver? I provide a few answers in this article.... When Will Silver & Gold Stocks Outperform? Gold has held up really well. It dealt with the second sharpest Fed tightening cycle in history and a huge move higher in the dollar. It has broken to a new all time high against foreign currencies. So when will it breakout? Here's a video that shows some history surrounding Fed rate hike cycles. How Long After Fed Hikes Does Gold Breakout? ------------------------------------------------------------------------------------------- The coming rate cuts will not be good for the stock market. Rate cuts are only bullish for the market when there is a soft landing. Otherwise, they are bearish.  This chart plots the cash for the Top 50 Gold & Silver mining companies. This data coupled with a breakout in Gold could lead to a surge in M&A.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #823 we added a company to our Top 10 list. This company has a potentially world class deposit (with great exploration results in a new area) and I could see it generating $250-$300 Million/yr in cash flow if Gold breaks above $2100. The company's market cap is well below $1 Billion. TDG #822 included our interview with the CEO of one of our Top 10 companies. The odds of this company being acquired this year are very high. The company is undervalued and could have another 50%-100% upside. The stock has started to move. In TDG #821 we analyzed 11 of our holdings over 6 full pages. We also included the company's current market cap & cash position. For new subscribers, those 6 pages can bring you up to speed very quickly. (Update also includes a watch list table of ~10 other companies with notes). In TDG #814 we assed the potential (in a table) of our top 10 stocks. Another file to bring you up to speed quickly. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options