|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold & Silver Correction Before Macro Catalyst....

Published: Mon, 05/22/23

|

|

|

Gold failed to breakout (for the time being) and is now correcting. Silver too.

I write about the why behind the correction, the short-term outlook and what will eventually push Gold & Silver into a new, real bull market. (Hint, it rhymes with that HBO TV show). Click below to ready my article. Correction, Then Macro Catalyst In this video I analyze the technicals and short-term outlook for the precious metals sector. Published Sunday. Gold, Silver & Miners Weekly Outlook Nevada King Gold is a sponsor of this free newsletter. The company discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. Nevada King is raising C$16 Million (no warrant) and doubled the size of their drill program. -------------------------------------------------------------------------------------------

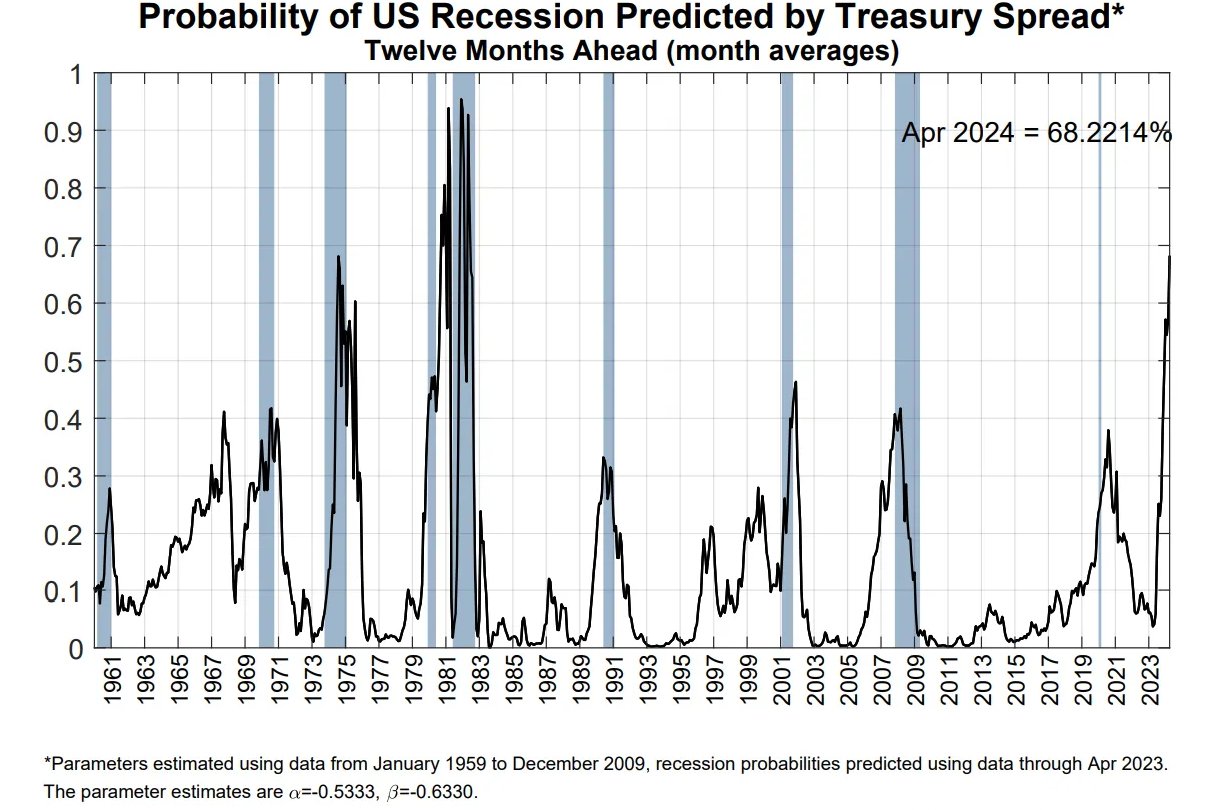

We are now at one of the highest probabilities of recession, ever.

Here is a chart of the LEIs (leading economic indicators). The LEIs are already at a recession level but a move down to -10 (-8 now) would likely confirm that.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #830 we wrote about Fed policy before and during the 2008 and 2020 bottoms. There are a few key similarities and there's a clear policy indicator that marked both bottoms. In TDG #831 we focused on short-term strength in the stock market and what it means for Gold. We also noted that the credit markets are not confirming recent strength in the S&P 500. Multiple indicators equate to an S&P price that is 300 points lower. TDG #831 also included our interview with a company that, in our loose opinion, could have the best project in the world (amongst Gold & Silver juniors). I do not want to give more hints but this is a "Holy Grail" type of company due to its production growth potential and exploration potential. Even if metals prices go sideways over the next few years, this company will perform well. If we get a real bull market in Gold, then this stock (which is trading around a 2-3 year low because a large seller liquidated their position over several months), could be a 7-bagger over the next 3 years. Subscribe to find out this company and other high quality companies with 5x+ potential. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options