|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold 2016-2023 = S&P 1974-1982

Published: Tue, 05/30/23

|

|

|

We noted last week that Gold failed to breakout (for now) and is correcting.

Do you think its weird how Gold is the only asset trading around all-time highs but the sentiment is terrible? This is one similarity with the stock market in the early 1980s. Take a look below at my comparison of Gold at present to the stock market in the early 1980s. Gold 2016-2023 Similar to S&P 1974-1982 I have been interviewing companies inside of TDG Premium for almost a year. Those interviews will continue. Now I am interviewing a wider range of companies publicly. Click below to watch the first public company interview. Don't Buy Lottery Ticket Juniors, Buy a Real Company In this video I provide big-picture technical analysis on Gold. Big Picture Technical Analysis on Gold Nevada King Gold is a sponsor of this free newsletter. The company discovered oxide mineralization at its Atlanta Mine Gold project in Nevada and has reported numerous, excellent drill hits. They have drilled high-grades over some lengthy widths. Nevada is the top mining jurisdiction in the world. There have been quite a few takeovers there in recent years and oxide projects are quite valuable. -------------------------------------------------------------------------------------------

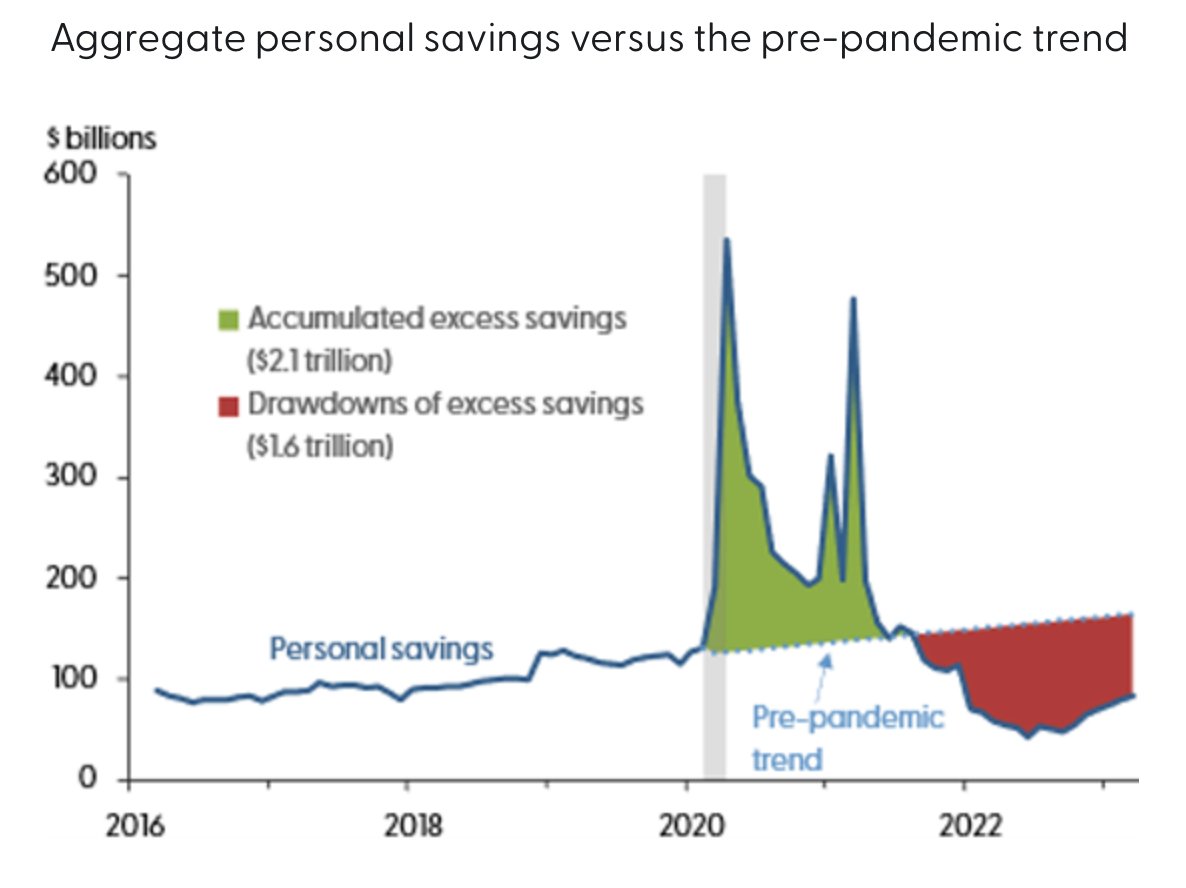

One reason the recession has not hit yet is because of excess savings from Covid stimulus have not run out yet.

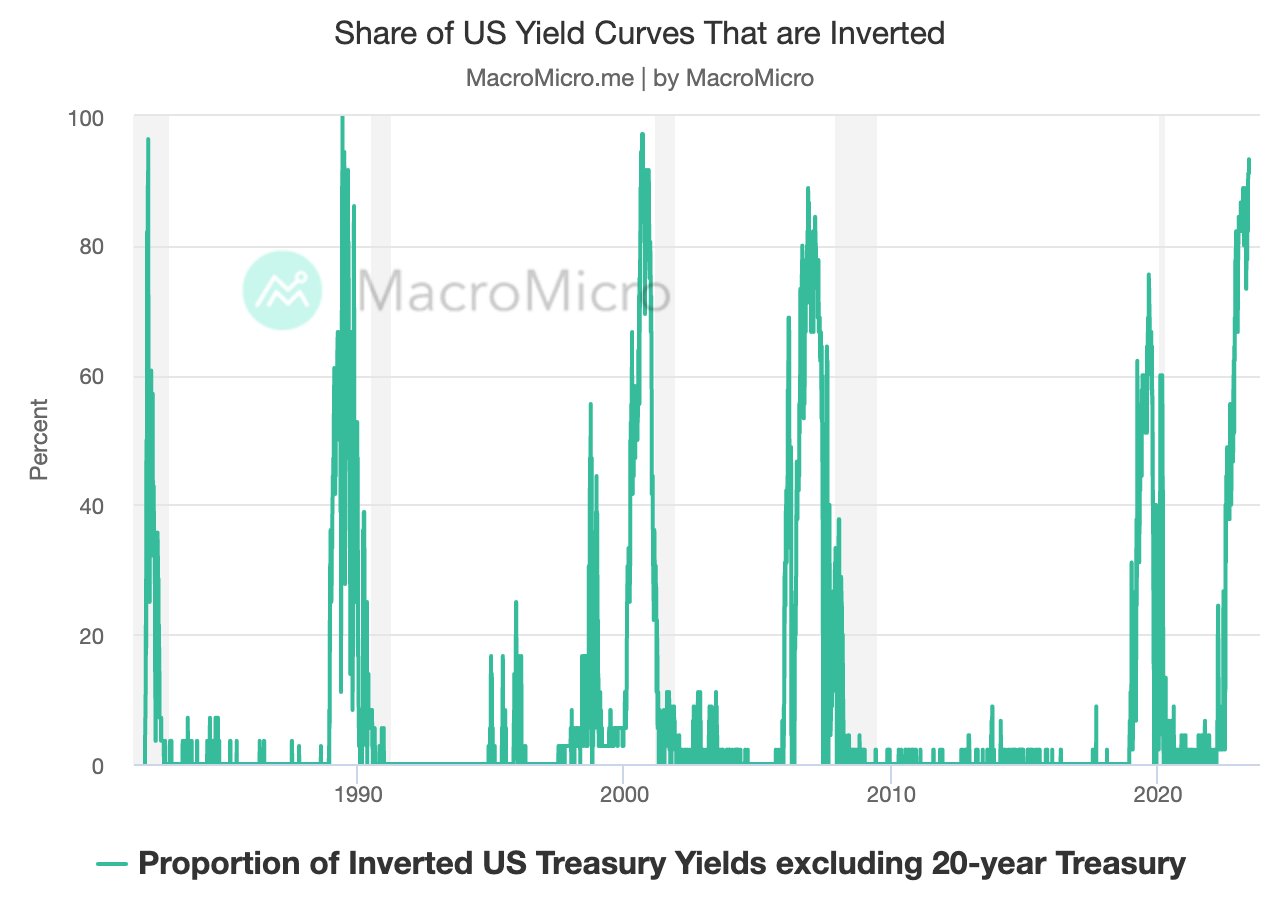

The projection is those savings will run out in Q4 2023.  This chart shows the percentage of yield curves that are inverted (higher short-term rates than long-term). The curves un-invert (or steepen) typically when short-term rates plunge, in anticipation of an immediate recession. Note that in each of the last four recessions, the curves un-inverted (steepened) prior to the recession. It will be 5 for 5.  ------------------------------------------------------------------------------------------- In TheDailyGold Premium... In TDG #832 we covered our public interview with Osino Resources, a private interview we did with another company and we created a hypothetical producer portfolio. A good number of our top 10 and watch list companies are producers but we included another two in a potential producer portfolio. If you want to avoid exploration stocks and you want growth that can earn big returns in a bull market (with slightly less risk), then this is a great list for you. With this list you get some exposure to a few world class assets, you get a bit of exposure to Silver, you get exposure to a few smaller producers that have 10-bagger potential and you get exposure to some producers that are investing in exploration. -------------------------------------------------------------------------------------------

|

United States Postal Service

PO Box 51131

Seattle WA 98115

USA

Unsubscribe | Change Subscriber Options