|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold Stocks Headed to Significant Low...

Published: Thu, 07/22/21

|

|

|

The ingredients for a significant low are starting to develop. It will take more time & more of an oversold condition & more bearish sentiment, but its quite possible we get a significant low in the coming months.

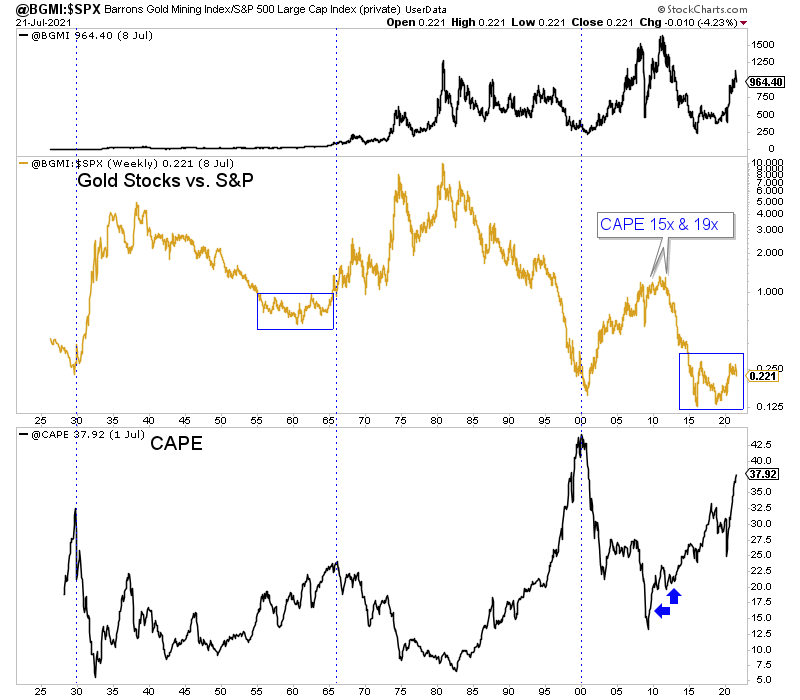

Click Here to Read My Article I touched on this last week. A real correction in the stock market will coincide or lead to a significant low in precious metals. Study history. Click Here to Watch the Video ------------------------------------------------------------------------------------------- The real bull market in precious metals has not even started yet. From a secular (10-20 year) standpoint, precious metals begin to outperform after valuations in stocks peak. We know that valuations are off the charts and expected returns for the 60-40 portfolio is the worst ever! This is a simple look but we plot the gold stocks against the S&P 500 along with the CAPE ratio (bottom). Gold stocks outperform massively after historically high CAPE ratios and underperform after historically low CAPE ratios. In 2009 & 2011 the CAPE was at 15 and then 19. Its at 38 today! That's the highest in history (ex the dot com bubble).  Subscribe to TheDailyGold Premium for Only $149

------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- From TDG #735... I spent a few pages discussing where we are in the big picture for Gold and this macro cycle. I happen to agree with Russell Napier. Click Here for his excellent interview. This interview taken with the chart above can really help you understand the present and the path forward for this cycle and for Gold. I analyzed all of that in TDG #735. Gold has a super bullish technical setup and if Napier's view about this cycle proves correct, we will see a massive move higher in the Gold market and the opportunity for multiple 10-baggers. I'm seeing a handful of stocks trading more than 35% off their highs with 10-bagger potential over the next 3 years. -------------------------------------------------------------------------------------------

|