|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Historical Comparison for this Gold Stocks Correction...

Published: Wed, 06/30/21

|

|

|

Gold and gold stocks are declining but a short-term low or a long pause in the decline is imminent.

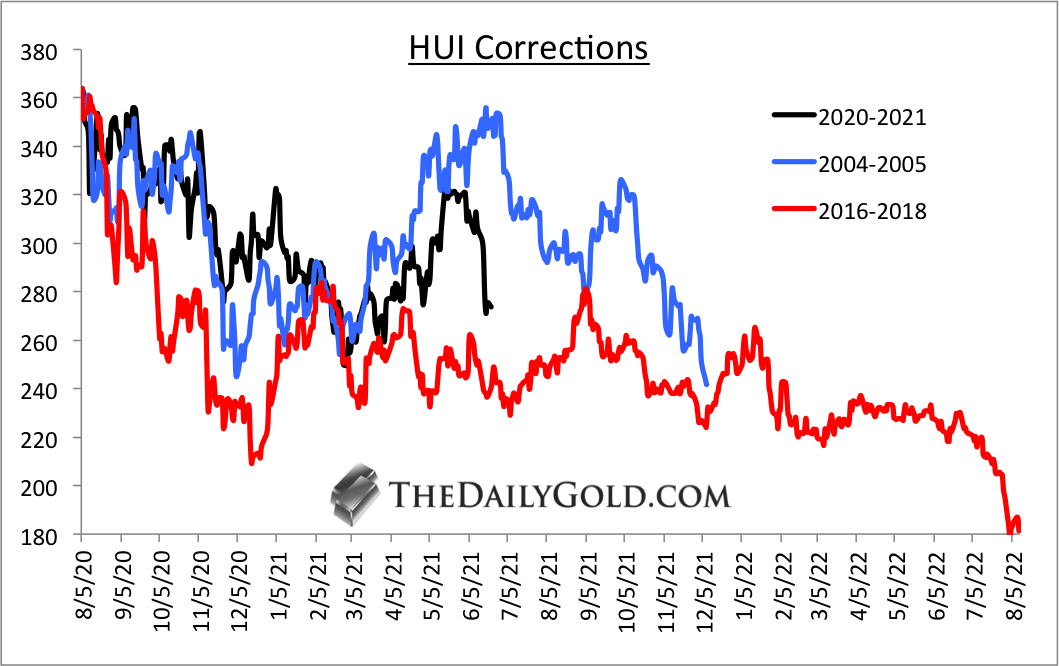

Right now, 0% of the HUI and 0% of GDXJ closed above their 20-day and 50-day moving average. Readings like these typically produce a short-term rebound, and Gold has good support around $1750. That's the good news. The bad news I don't expect this rebound to be the start of some massive leg higher. More analysis on that in this video update, published Tuesday. My answer to the question (in multiple interviews) of what it will take for the correction/consolidation to end and for Gold to breakout, has been one word: TIME. It's going to take more time. In the meantime, we have to understand the trajectory the market is on over the next few quarters but also the next few years, and act accordingly. In my opinion that means favoring quality. It means buying significant weakness and not chasing strength. It also means avoiding riskier, more leveraged plays. They'll come into vogue again but it can be expensive to wait. On the macro-market side, we have to analyze the price action, along with potential leading indicators and then sentiment indicators. We evaluate the current outlook for Gold's leading indicators in this article. I was encouraged by the improvement in the Gold CoT, as the net speculative position decreased quite a bit and yet Gold remained some $100/oz above the spring low at $1675. We have the setup to bounce as the summer heats up. But medium term, the outlook is still soft to bearish. ------------------------------------------------------------------------------------------- Here is an analog that compares three corrections in the HUI. We have 2004-2005, 2016-2018 and the present correction which began August 2020. In the video you can see the charts and why I make the comparison. The good news is the current correction appears a bit more like the 2004-2005 one (lasted 17 months), than the 2016-2018 one (lasted 24 months).  Subscribe to TheDailyGold Premium for Only $149

------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com

|