|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Gold: Weak Technicals but Catalyst Emerging...

Published: Tue, 09/21/21

|

|

|

The catalyst for the next leg higher in Gold is likely to be a significant stock market correction, or the Fed begins hiking rates.

I've detailed the historical evidence behind those catalysts in past articles and videos. For my current analysis, go read my editorial from a few days ago. Steve Saville, one of my favorite authors details why Gold isn't in a bull market, but expects Gold to do well when the current boom unravels, which could be in the first half of next year. Read it here. Given the current technicals of Gold & gold stocks, it's quite possible sometime in the first half of next year is a major turning point. ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

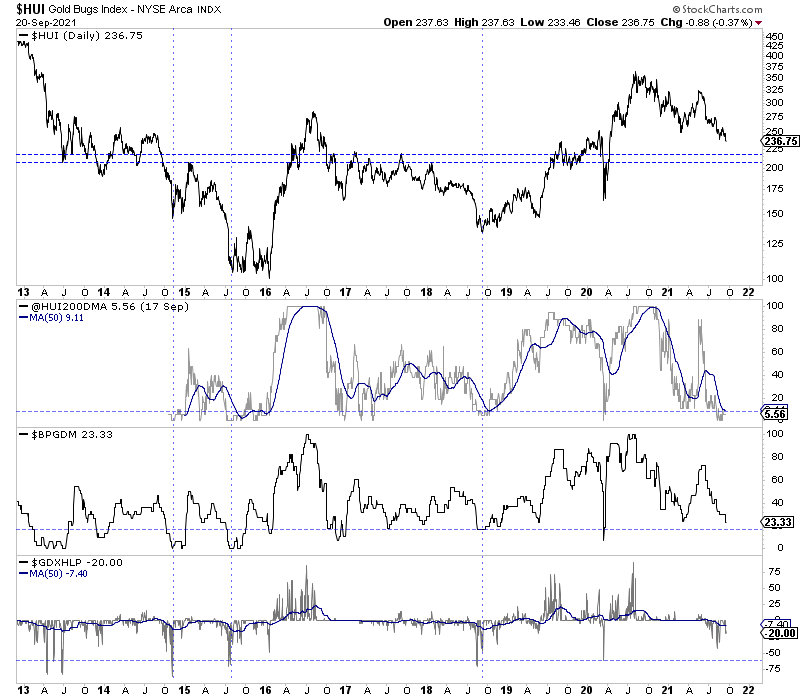

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- Here is a chart of the HUI along with three breadth indicators. Two are GDX indicators & the top one is mine (% of HUI stocks above 200-dma). In trying to assess a low-risk entry point we want to focus on price and breadth indicators. The HUI has support at 215 and 205. The BPGDM indicator closed at 23%. That bottomed at 15% in 2018 and much lower in March 2020. At the bottom is the new 52-week lows in GDX. Note that when this indicator spikes above 50%, a temporary bottom is likely. It's also possible there is a low and then it takes a few months to confirm that low with a retest, double bottom or false new low.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

In TDG #743, a 24-page update sent Sunday, we provided an update on our holdings and one watch list company. Call it our top 10 list. This is a list of quality juniors that are fundamentally sound and have fairly high odds of success. Say the Gold price ranges from $1500 to $1800 for another 12-18 months. (Not my prediction, but important to consider). These companies have the ability to add value in that environment, and they have significant upside potential at $2000 Gold. We wrote about the current developments for each company as well as its long-term upside potential. (You don't endure the downturns in this sector for 50%-100% gains. The potential has to be far greater.). Also we included support and buy targets (which for the most part align with $1600 Gold). The week before we did add a few optionality-type of plays to our watch list. A few of these companies could be worth buying when the sector bottoms. -------------------------------------------------------------------------------------------

|