|

Jordan Roy-Byrne, CMT, MFTA |

TheDailyGold: Short-Term Low in Gold Stocks, but Fundamentals....

Published: Thu, 10/07/21

|

|

|

Coming into this week I was hoping for another round of selling that could push the HUI and GDXJ to 216 and 35.

After Tuesday I informed subscribers I'd be closing my hedge Wednesday, as the odds of a further decline had decreased. This sector never makes it easy. For my current thoughts, take a look at my most recent videos. In this video, I explain why Gold's fundamentals are not bullish yet and what has to change. I do think that within the next 2-3 quarters, Gold's fundamentals will be bullish again. In this video, I assess the super-bullish bases in spot commodity prices (an equal weighted basket) and metals prices. I also argue the next catalyst for those groups and the US$ in 2022. ------------------------------------------------------------------------------------------- I have seen and tried a few of the newsletters. Yours is by far the best, yours is the only one that really gets the technical analysis down. Fundamentally I really like your picks. They are all low risk minimal downside with huge upside. I have found some of the other newsletters pick a lot of risky exploration stocks or they simply have far too many companies. You seem to

sift through the best and recommend a simple more condensed list with big upside.

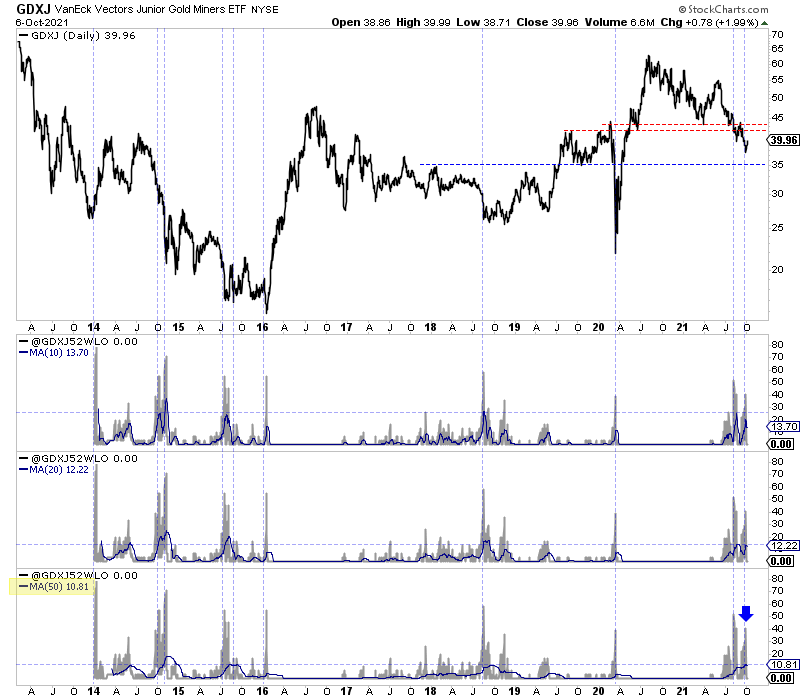

Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- Here is a chart of GDXJ, along with new 52-week lows, dating back to 2014. This is my proprietary indicator. I was hoping we'd get a spike to +50% and GDXJ testing $35 at the same time. Maybe that's possible at a later date. Maybe not. A 50-day moving average of the new 52-week lows (bottom panel), shows the second most oversold condition for GDXJ in nearly 8 years. Potential rally targets are $42-$43.  ------------------------------------------------------------------------------------------- "I am simply a pure market-timer for a broad basket of gold stocks and precious metals. Jordan, on the other hand, has provided superior STOCK-PICKING abilities over the longer-term. I am familiar with most gold stock subscription services over the past 30 years. I rarely provide endorsements of any kind, but Jordan's ability to analyze individual gold/silver stocks has been among the top 5 services over the past decade. First and foremost, I respect his integrity. -Jeffrey Kern, SkiGoldStocks.com Subscribe to TheDailyGold Premium for Only $149 ------------------------------------------------------------------------------------------- In TheDailyGold Premium...

I have a solid top 10/11 list of companies for the reemergence of the bull market. All of these companies can add value in a fixed price environment, but obviously have huge upside if we see $2000 Gold again. I also have a few optionality plays on my watch list. Some of these have been hit hard in recent weeks but that only increases the long-term potential from this point. I think half my list are no brainer potential 10-baggers and that's not assuming a $3,000 or even $2,400 Gold price. -------------------------------------------------------------------------------------------

|