|

|

November 22, 2022

Subscribe to Mining Memo

|

|

Mining Market Update

|

| Price |

$16,214 |

▲0.5% |

| Hashrate |

261 EH/s |

►0% |

| Difficulty |

36.95 T |

▲0.5% |

| Revenue* |

$0.055 |

▼-6% |

|

|

|

|

Falling Bitcoin price, debt obligations loom for Marathon Digital

|

|

Marathon Digital, one of the largest North American Bitcoin miners listed on the Nasdaq exchange, swung and missed on its reported Q3 financials earlier this month, announcing a $75 million loss during the last financial quarter and a $280m loss, year to date.

While large, the values are not unexpected, especially when considering Marathon Digital remains one of the largest Bitcoin hodlers of any public company, and the price of Bitcoin has dropped by 75% from its 52 week high. (GAAP accounting standards currently require

the impairment of digital currencies held to be recorded. Marathon Digital accounted for a $153 million loss in value, year-to-date).

Yet headwinds persist:

-

Marathon Digital shareholders did not approve the increase in authorized share capital to 300 million at the annual shareholders meeting on Friday, November 4.

-

Gross mining profit–when taking the revenue and deducting the direct costs associated with mining–were only 36% over the last three months.

-

Lastly, Marathon Digital has not currently sold any of its 11,440 Bitcoin held, but 83% are held as leverage against two loans totaling $100 million.

|

|

Continue reading here.

|

|

|

|

|

Enhance Your ASIC Education with Foundry Academy

|

|

The future of digital asset mining calls for top technical talent. Led by industry-veteran instructors, Foundry’s Mining Intensive and Mining Technician programs provide hands-on education for professionals and enthusiasts.

|

|

|

|

Mining News Feed

|

|

Forbes / Bitmain-Backed Crypto Mining Company Among Creditors Of Sam Bankman-Fried’s FTX

|

|

|

|

CoinDesk / Bitcoin Mining Giant Core Scientific Ended October with $32M in Cash

|

|

|

|

The Block / Bitcoin miner Iris Energy unplugs hardware collateralizing over $100 million in loans

|

|

|

|

|

|

|

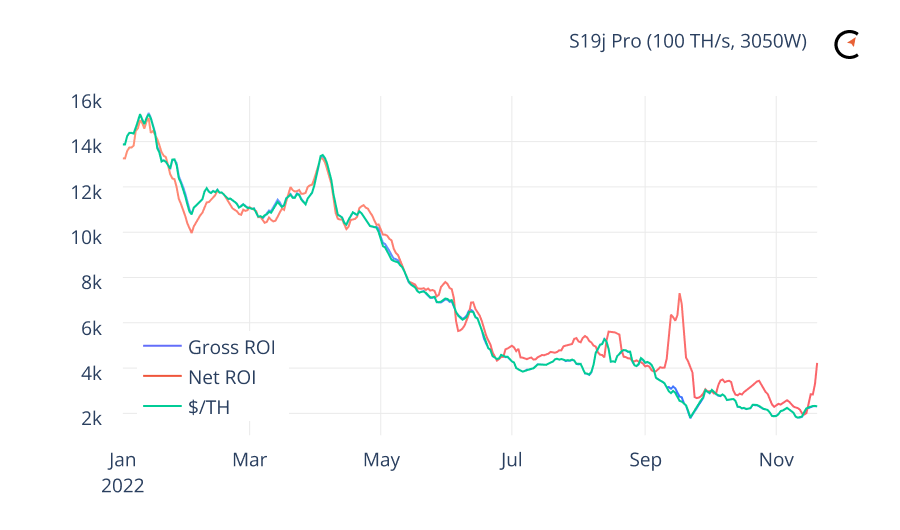

| ROI for the Antminer S19j Pro 100 TH series continues to trend downwards, hammered by two year lows for Bitcoin price and all time difficulty highs. Most S19 models are mining in the red if using energy sources over $0.08/kWh. |

|

|

|

|

|

We discuss Marathon’s 2022 including the storm that knocked out its Hardin site, getting 9 EH/s online, EGS regulations, OFAC compliance, if the hosting model is broken or not, Marathon’s finance strategy and why Marathon hasn’t sold its

Bitcoin.

|

|

Watch on YouTube here.

|

|

|

|

|

|

| Bit Digital |

6.18% |

$0.89 |

$10.22 |

| CleanSpark |

4.70% |

$2.22 |

$18.48 |

| Bitfarms |

5.43% |

$0.58 |

$8.24 |

| Marathon Digital |

3.47% |

$6.47 |

$57.70 |

| Hut 8 |

1.33% |

$1.14 |

$13.28 |

|

|

*As of Tuesday, November 22

|

|

|

|

|

About Compass: Compass is a Bitcoin mining and modern media company focused on driving the mass adoption of cryptocurrency mining.

|

|

|

|

Did a friend forward this email? Sign up here.

Want more Compass content?

|

|

|

|

|

|

|